The maze of car insurance in Pittsburgh PA is like walking through the complex maze. With the myriad of options and changing rates, finding an affordable insurance policy is essential for drivers in the local area. The diverse Pittsburgh neighborhoods, starting from the lively downtown area to peaceful suburbs all have their own unique concerns regarding insurance. Things like the density of traffic, crime rates and even the weather conditions could affect premiums. For example, those areas that are susceptible to snow storms that are heavy could see more expensive rates because of an increased risk of accidents.

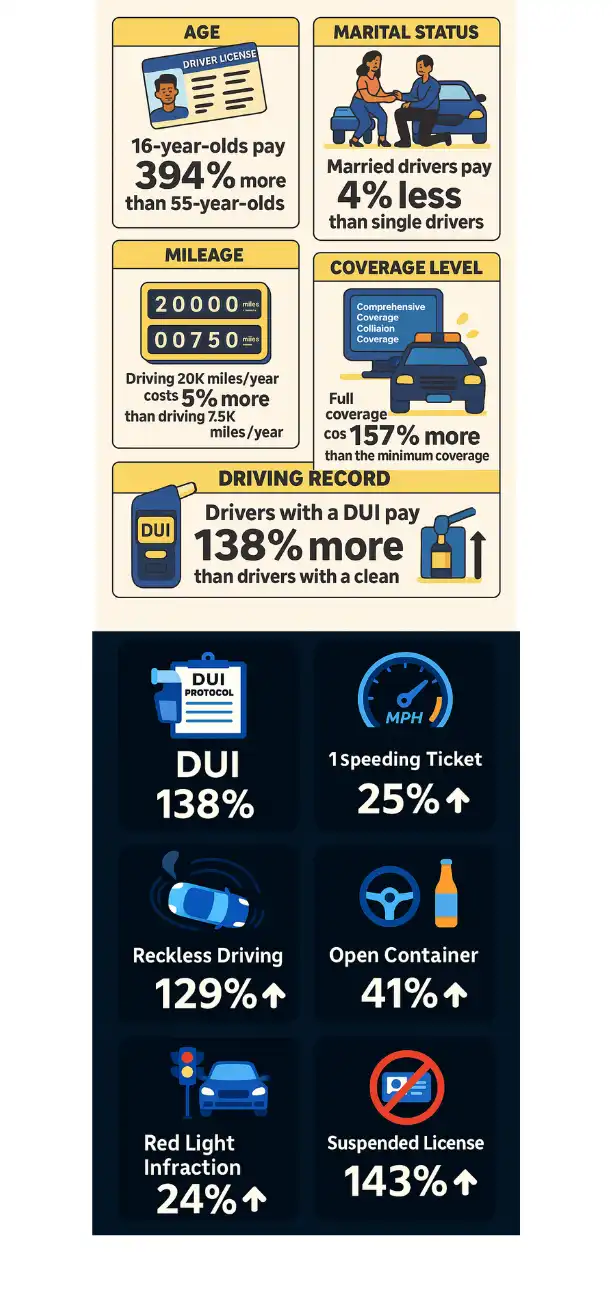

Additionally, the city's economy also plays an integral crucial role. There is a mixture of professionals, students and retirees, insurance companies assess the risk profile of each person in a different way. Drivers who are younger may face greater premiums due to their perception of inexperience. However, experienced drivers may benefit from lower rates. Knowing these factors is crucial. Through being aware and proactive, Pittsburgh residents can secure low-cost policies that do not compromise in coverage.

Why is Car Insurance Essential in Pittsburgh PA?

In Pittsburgh, Auto insurance is not just a suggestion, it's an obligation of law. State law requires that every driver carry a minimum amount of liability insurance to guarantee that they are financially responsible in the event that they are involved in an accident. This is to protect not only drivers but also all road passengers. In the absence of insurance, motorists are subject to penalties such as the possibility of license suspensions or fines.

In addition to legal requirements Insurance provides financial security. In the event of an accident, it can be costly, from car repairs to medical expenses. An insurance plan that is well-constructed will protect drivers from unanticipated expenses. Furthermore, in a place where there are a wide variety of terrains, weather and conditions, the risk of accidents is higher and insurance is more essential.

Additionally, insurance plays a vital role in assisting with the process of recovering from an accident. It helps with quick repairs, medical procedures as well as legal aid in the event of need. Car insurance in Pittsburgh PA is a safety cover, assuring that motorists have the ability to travel in peace and safety.