What is the Car Insurance for Young Drivers?

Table of Contents

Driving for the first time as an adult can be thrilling, but the cost of car insurance could be an irritant. In reality, the insurance offered to young drivers typically is a high-cost for the cost. This is because insurance companies view young drivers as a danger because of their lack of knowledge of driving as well as the statistically greater chance of a crash. However, that doesn't mean that youngsters are stuck with high premiums for life.

Good part? There are a variety of methods and tricks to help cut down costs without degrading protection. Starting with choosing a suitable insurance company and applying for discounts or adjusting the policy to save money, you could reduce your expenses if you make the right choices.

In this thorough guide, we'll cover all the information that youngsters and their parents should know about getting an affordable and reliable insurance policy for their car. If you're aged 18, 21 or even 24, this post is for you.

What is the Car Insurance for Young Drivers?

No one insurance provider is ideal for all. For young people, some insurers shine more than others due to their prices, customer support, and features for teens.

Car insurance that is suitable for teens generally covers:

- Affordable Costs / Affordable Premiums: This is the main reason why you should not buy. The lower your base rate is, the less you pay—especially if you bundle discounts.

- Large Discounts: Student discounts for good grades, safe driver rewards, and telematics services can cut costs in a big way.

- Flexible Coverage Choices: There is no need for a premium package. What you require is flexible and budget-friendly coverage.

- Mobile App and Digital Tools: You're always on your mobile, so your insurance provider should be too. Look for an app that lets you track your insurance, submit claims, and get roadside help.

Based on customer feedback and expert rankings, companies such as InsurancePittsburgh.us, Geico, Progressive, State Farm, and Allstate are known for great discounts for young adults. They offer valuable add-ons, online perks, and accident forgiveness programs for young drivers.

It’s more than cost. You want an insurer who won’t ghost you when filing a claim or force you through hurdles. So when shopping, take time to read reviews and check customer service quality.

Insurance needs shift with age, so it’s worth comparing with Cheap Car Insurance for Seniors.

How Much is Car Insurance for Young Drivers?

The shocking fact is that insurance for cars owned by young adults is one of the most costly of all age groups. Why? Since statistics show that drivers younger than 25 have a higher risk of being involved in accidents and have more claims. Insurance companies base their premiums on risk, and young drivers pose a risk to their businesses.

These are some approximate estimates:

- Ages 18-20: $4,000 - $6,500/year

- Ages 21-24: $2,800 - $4,200/year

- Age 25+: drops to $1,800 to $2,500 per year

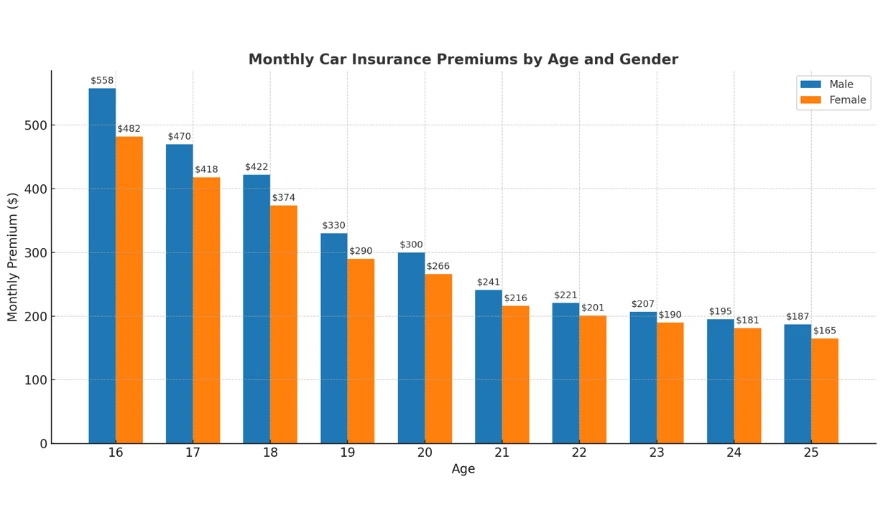

The gender of the person can affect prices. In general, males of younger ages have higher prices than females due to the historical data on accidents. It's also the choice of your vehicle that is important. A sleek coupe may look stylish, but they are more expensive to cover than a middle-sized car.

Be encouraged because of the figures. By using the correct method, you'll be able to lower the price dramatically.

Car Insurance Costs for Young Adults by Age

Age is a major factor in the amount you'll have to be charged for auto insurance. This is a fuller analysis:

- 18-year-old drivers: Drivers who are just out of high school (or are still in the process of completing the process of completing it) and are the most danger group. They're not the most frequent drivers and, if they're included in a policy of a parent and are covered, their costs will be reduced. On their own, they would have to pay up to $6000 annually.

- Drivers aged 21: When you reach this age it is possible that you are in university or preparing to enter the workforce. Your driving records begin to age and, if your driving record is clear, the insurance company will offer reduced costs. You can expect to pay between $3,500 or $4,200 annually.

Your record of driving, your claims background, or your location could affect the averages however, age is the primary driving factor when it comes to pricing models.

Car Insurance Costs for Young Adults by State

Your location can significantly affect the amount you have to have to pay for insurance on your car. This is because Every state has a different set of minimal insurance requirements, laws and frameworks, statistics on accidents as well as weather patterns, all which impact rates.

Example:

- The most expensive states: Michigan, Florida as well as Louisiana always top the list for having the highest rates. These are due to reasons like insurance law that does not require fault as well as high rates of accidents as well as the cost of lawsuits.

- The most affordable States: North Carolina, Idaho, and Vermont typically have cheaper prices due to a less population density, better roads, and less claims.

Here's a quick snapshot:

| State | Avg. Annual Premium (Age 20) |

|---|---|

| Michigan | $6,400 |

| Florida | $5,800 |

| California | $4,500 |

| Texas | $4,300 |

| Ohio | $3,100 |

| North Carolina | $2,600 |

The quality of life in a rural vs. urban location also affects. Urban drivers are more vulnerable to accidents, more thefts and higher claims therefore, they typically pay more.

Compare plans and quotes in our full resource on car insurance Pittsburgh, PA.

How Are Rates Determined for Young Drivers?

Have you ever asked yourself, "Why is my insurance such a high cost?" --you're not the only one. Knowing how insurers calculate their cost of insurance can assist you in making better decisions to reduce your cost in the long run. This isn't a random amount that is based on the exact formula used to analyze the risk.

This is a glimpse at how the rates are calculated to help young drivers.

1. Driving History

Because the majority of young drivers are brand new on the roads as a result, they don't have any record of their driving. Insurance companies have known about the level of safety they'll be driving, which can result in higher premiums. Just one ticket for speeding or an accident of a minor nature can push your premiums significantly.

2. Type of Car

Perhaps you dream of driving through the streets in the back of a Mustang or BMW however, high-performance luxury cars have more expensive insurance rates. Why? because they're more expensive to fix and also more likely to be taken. More secure, dependable, smaller automobiles (like such as a Honda Civic or Toyota Corolla) are less expensive to protect.

3. Location

Your zip code affects your insurance. Regions that have high rates of crime and frequent claims or a lot of traffic congestion generally have higher rates. Your proximity to major roads and intersections that are prone to accidents can have an impact on.

4. Credit Score

In all States (except California, Hawaii, and Massachusetts) the credit score is a major part. An excellent credit score indicates an obligation to pay, which corresponds to fewer claimants.

5. Coverage Limits and Deductibles

The more insurance you get for, the more premium you'll have to pay. Choosing Comprehensive, collision and high deductibles will mean you'll pay over more every month however you'll have to pay more in the event of an accident.

6. Gender and Age

Statistics show that young men are the most likely to indulge in reckless driving habits. This is why males typically have a higher cost of insurance than women at around age 25 as the gap begins to narrow.

Insurance companies collect and analyse years of information using complicated tables of actuarial data. Anything from your high school GPA to the location you park in garages can affect your rates. Understanding these variables can help you determine what you need to do to get your rates lower.

Ready to Get a Free Quick Quote?

How To Get Cheap Car Insurance for Young Adults

We'll admit it: when you're an adult in your 20s you're on a tight budget. If you're paying for rent, college or saving to buy your first car one of the last things you'd want to do is pay a huge insurance cost.

However, don't worry about it. It's possible to get cheap insurance for your car without losing essential protection. Here's how:

Reduce Your Coverage Limits

If you're driving a dated or a less costly vehicle, obtaining insurance coverage doesn't always make economic sense. Collision and comprehensive insurance covers any damage to your vehicle, however when the vehicle isn't valued at all, the amount could be lower than costs.

This is how you can reduce the coverage you have:

- Stay with the State Minimums: Every state requires liability insurance, but there's no need for additional coverage.

- Do not pay for Collision and Comprehensive: In the event that your vehicle's value is below $3000, it could be more beneficial to take the cost of a monthly subscription.

- Beware of Gaps: Reduced coverage will mean higher costs out of pocket in the event of an accident. Make sure you have the money to cover repairs or the replacement of your vehicle yourself.

Before you lower limits, consider the potential risks. Are you in an area with a lot of traffic? Do you have enough cash to cover urgent repairs? If you don't, then it could be more beneficial to maintain a larger insurance.

Take Advantage of Discounts

Discounts can be your best weapon. Young drivers often don't know the amount of savings they are eligible to receive. These are the questions you need to inquire concerning:

- Great Student Discount: If you maintain a grade of B or better average and get a discount of up to 25 percent.

- Safety Driver Discount: You haven't had any incidents or violations for 3 years? It's cash in your pockets.

Be sure to ask your insurance company about discounts offered. You could be leaving thousands of dollars on the table.

Increase Your Auto Insurance Deductible

Deductibles are the sum you are able to cover out of your pockets before insurance kicks into effect. The increase in your deductible from $250 to $1,000 can decrease your monthly cost by between 15 and 30 percent. It's a lot of money.

However, here's what you have to consider: If you're involved in an accident you'll have to pay the initial costs on your own. This is a wise choice but only in the event of:

- You're confident when you drive.

- There is enough money saved to cover the more expensive deductible should you need it.

- It is not recommended to drive frequently or in highly-risk zones.

If you're a young adult financially secure it is among the fastest ways to cut down on the cost of insurance.

Bundle Your Insurance Policies

There are plenty of commercials that say, "Bundle and save !"--but this is more than a slogan for marketing. Bundling insurance policies can make sense, particularly those who are young and trying to save money wherever they can.

Raise Your Credit Score

It's a fact that is often unnoticed by individuals: your credit score is a factor in your insurance premiums. Though it could appear unrelated however, research shows a significant connection between poor credit scores and a greater quantity of claim.

Car Insurance for Young Adults: FAQ

Are newer cars cheaper to insure for young adults?

- New cars often include advanced safety features that may lower premiums

- They usually cost more to repair

- They have a higher replacement value

- They often require full (comprehensive) coverage

- Older, safe-rated sedans are often cheaper to insure

Is insurance cheaper once you turn 25?

- Yes, typically premiums drop 15%–30%

- Insurers consider you more experienced and lower risk

- Having a clean record, good credit, and no major claims helps reduce costs

- Bad driving habits can prevent the discount

Can I stay on my parents' insurance after turning 18?

- Yes, if you live at home or attend school full-time

- This can save you thousands annually

What is telematics insurance?

- It's usage-based insurance using an app or device to track your driving

- Safe driving can earn significant discounts

Do grades affect car insurance costs?

- Yes, many insurers offer a good student discount

- Usually applies to a B average or better

- Especially helpful for drivers under 25

Should I buy a cheaper car to lower my insurance?

- Only if the total cost (car, insurance, maintenance) is truly lower

- Always compare overall expenses before buying

Is it better to pay for insurance in full?

- Yes, paying annually usually earns a discount

- You avoid extra monthly installment fees

Conclusion

Finding low-cost car insurance when you're an adult may seem as if you're trying to win the lottery, but it's much easier than you imagine. Your age and your lack of history with driving can be a hindrance to the insurance company However, there are tons of options for reducing your premiums. Starting with smart buying and bundling your policies, to raising your credit score or getting discounts The tools are available, you must use these.

What's the best thing? As you grow older and get more comfortable driving, things will only improve. Prices drop, choices increase and you'll feel more confident in deciding on exactly the coverage you need.

Younger drivers often struggle with rates, but there are still options for cheap car insurance in Pittsburgh, PA.

It doesn't matter if you're receiving your driver's license or are nearing the age of 25, you shouldn't be settling for high costs. Make yourself aware, be informed and compare until you can find the best policy to fit your budget as well as your needs.