Enter your ZIP code below to discover companies offering the most affordable

auto insurance in your area.

It's true that getting older is a great time to enjoy a variety of advantages, however affordable automobile insurance isn't necessarily an option. If you're an older person trying to navigate the maze of car insurance, then you'll probably be thinking: can I be able to get a decent coverage without having to pay the price of a million dollars? Yes, but it's important to be aware of where to search.

When drivers get older, their experiences behind the wheel may benefit them which can lead to lower accident rates and more safe driving practices. Yet, in the meantime the insurance industry can raise rates because of age-related danger factors. It is therefore crucial that seniors shop wise and understand the options available to them to take advantage of discounts that are available.

In this article we'll go over all you need to learn about finding the top low-cost car insurance options for older adults. From understanding the types of coverage essential to identifying discounts that aren't widely known We've got your back. Get ready, let's explore the world of car insurance plans that won't break the bank.

For seniors considering broader protection, Comprehensive Car Insurance can provide peace of mind.

Car insurance shopping as an adult isn't quite similar to what you did during your 40s or 50s. The priorities shift. It's likely that you'll drive less, perhaps to get groceries and doctor's appointments or weekends visits with your grandkids. The changes in your lifestyle affect your insurance needs and if you have the right plan this can lower the rates you pay.

Seniors generally require dependable coverage which balances cost-effectiveness with security. Newer models with safety features with limited or no-driving restrictions and years of safe driving record are major advantages. Insurance companies could begin increasing their rates as they reach 70 due to the perceived risks such as slower response times or medical problems.

You should review your insurance policy in order to determine if that it is in line with your behavior. Do you require complete coverage for a vehicle that you don't use often? Do you have to pay for additional services like roadside assistance with several providers? Examining your coverage each year could help you save hundreds of dollars.

Insurance is not all made equal. What you were looking for at 40 may not be appropriate today. Let's take a look at different kinds of insurance that seniors need to consider beginning with the basics before moving on to the more expensive options.

Liability insurance is required by all states. It protects against damage to property of others or injuries resulting from an accident in which you're the one to blame. It's essential--no matter your age.

When it comes to seniors seeking to reduce their liability, selecting the correct limits is essential. The state minimum limit might seem less expensive, however, in the end the risk is that you'll be vulnerable. You should consider increasing the limits you have when you have substantial assets that you want to safeguard.

They aren't required except if you're financing or leasing your car. Collision is a way to cover damages to your vehicle following an accident. While comprehensive covers things such as vandalism, theft or damage from weather.

If your vehicle is older and isn't worth much it is possible to drop those insurances. If, however, you own an older vehicle or need assurance, holding the coverages can be beneficial.

Medical expenses can mount fast, particularly when you're living on an income that is fixed. Protecting yourself from personal injury (PIP) and medical payment insurance help you pay the medical costs incurred following an accident, no matter who was responsible.

They can be particularly useful especially for older people, who could be more prone to injury and longer recovery time. These are also useful if you do not want to pay Medicare or health insurance privately for deductibles in the event of an incident.

The fact that you've reached your golden years, it doesn't suggest that you must be paying the highest price for auto insurance. Actually, this phase of life is the ideal moment to review your insurance policy and adjust it to better meet your requirements and budget. A lot of seniors are shocked at how much they could save simply by changing certain aspects and asking the appropriate questions. Let's go through the steps you can take to ensure you get the cheapest auto insurance, without losing the security you require.

It is important to not assume that your current insurer is offering you the lowest price. Rates for insurance change constantly according to internal algorithms as well as risk pools and competitors. The rates that were affordable in the past could be priced too high in the present. Make sure you get estimates from three different insurance firms as your renewal date is approaching. Check out comparison websites, or call representatives directly to determine the possibility of getting better prices elsewhere. If you're happy with your insurance company, giving their quote from a competitor can result in a price match, or an extra discounts.

There are people named in your insurance who can not drive the car anymore? Perhaps your grandchild has quit driving or your spouse that gave up driving? The removal of unnecessary drivers may reduce your insurance premium. Be sure to ensure that your use type is accurate. If you're not driving regularly and you only travel occasionally, change you status from "pleasure driving" in order to reduce the cost.

It's easy to win by taking the state-approved defensive driving classes. Insurance companies often offer discounts ranging from 5and 15 percent to seniors who take the class. The courses will refresh your knowledge and teach safe driving practices and may include advice on how to handle the aging challenges on the road. Best part? A majority of classes are available on the internet in a matter of hours.

All vehicles are not created identically in the eyes of insurance companies. The luxury cars, sports vehicles as well as high-performance vehicles generally have higher rates. If you're considering selling or downsizing your vehicle, think about the option of a small SUV or another vehicles that are low risk. Vehicles that have high security ratings and minimal repair expenses are generally less expensive to cover.

Do you want to assume the financial burden when you face an insurance claim? The increase in your deductible by $250-$500 or even $1,000 will significantly decrease the monthly cost. Be sure to keep this amount saved for the event that you have to utilize it.

Many insurance companies love it to have you bring in new business. If you have a house or own a second car you should think about bundling your insurance. Discounts for multiple policies can reduce your costs by 10% or 25%, depending on the service. The convenience is that everything can be accessed in one place, and generally, you'll have better service from the customer.

The security features in your vehicle may be more than just protecting you. They could save you money too. Cars with safety features such as anti-lock brakes, warnings about lane deviation as well as adaptive cruise control airbags and anti-theft devices are often eligible to get discounts. Inform your insurance company of the technology in your car If it can lower risk, they'll usually pay you.

Although it may seem obvious, don't put money in the bank. Request your insurance provider to examine every discount that you're eligible to receive. They could cover:

Certain discounts are stackable, and even small savings may accumulate quickly.

Though monthly installments can seem more manageable, paying your insurance in full could cut 5%-10 percent off the cost of your insurance. If you're able financially to pay one installment upfront this is a wise choice which will make budgeting easier and also your budgeting.

If you're not a driver, say 7500 miles or less per year, usage-based insurance might be your chance to save big. The policies monitor your miles and your driving habits using the use of a mobile device or small application. Be careful and cautious Your insurance company could lower your rates considerably. Companies such as Progressive, Allstate, and State Farm all offer these kinds of plans.

Everyone loves a price, particularly when it's like car insurance, which is a lot more expensive? There are many opportunities to save money but the key is knowing what discounts to inquire about. The insurance companies don't often advertise them, which is why you need to take advantage of them.

Seniors looking to save can often benefit from discounts on cheap car insurance Pittsburgh, PA.

One of the most straightforward methods for seniors to earn discount rates is to take one of the defensive driving courses that are state-approved. The courses are designed specifically for seniors and include important topics such as dealing with diminished vision, adapting to slower reflexes and taking care of the effect of medication on driving.

In addition, they can ensure you are a safe driver, they also will make you more attractive to insurance companies. In most states, taking courses can cut 5 to 15% off your monthly premium in the span of 3 years. Many courses can be found on the internet and are priced at less than $30. This is a minimal cost to save for the long term.

If you're in retirement or just no longer driving then let your insurance company be aware. There are many insurers that offer discounts for low mileage for drivers who drive between 7,500-10,000 miles per year. This is logical since less driving time results in less chance of collisions.

Certain insurers provide UBI or usage-based insurance (UBI) programs that monitor your miles using the use of an app or a plug-in device. If you're driving in a manner that's safe, you may be eligible for higher discounts, as high as 30% in some cases.

Are you with the insurance company for some time without complaints? It is possible that you qualify for a loyalty bonus. The discounts vary depending on the provider, but could be at least 10% for policy holders with a long-term contract.

In addition, if you've got an impeccable driving record, with no incidents or violations within the last 3-5 years, you could get a safe discount for drivers. Many companies incorporate this into telematics systems that encourage gentle braking moderate acceleration, and low evening driving.

Do you want to know how your rate compares with others in your position? Knowing the average rate can offer a sense of perspective and assist to determine if you're paying too much.

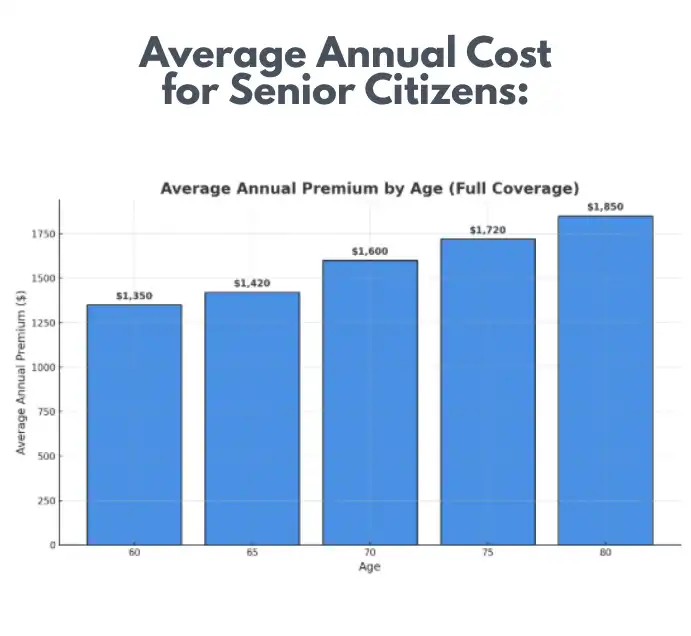

This is a summary of the average annual cost for senior citizens:

For tailored coverage, see our guide on auto insurance in Pittsburgh.

We've covered many topics however, you might be unsure. Below are the top asked questions, with solutions that are easy to understand.