What is Comprehensive Car Insurance Coverage?

Table of Contents

- What is Comprehensive Car Insurance Coverage?

- What Does Comprehensive Car Insurance Cover?

- What Damage is Not Covered by Comprehensive Coverage?

- Comprehensive Coverage vs. Collision Coverage

- How Does Comprehensive Insurance Work?

- What Types of Comprehensive Coverage Are Available?

- When is Comprehensive Insurance Worth It?

- How Much Does Comprehensive Car Insurance Cost?

- Is Comprehensive Insurance the Same as Full Coverage?

- Is It Better to Have Comprehensive or Collision Coverage?

- Should I Get Comprehensive Coverage or Liability Coverage?

- FAQs

- Conclusion

- Related Articles

Comprehensive car insurance commonly known as "comp coverage," is the type of insurance that protects you from damage to your car that is not resulted from a collision. It sounds simple, doesn't it? There's something more under the layer.

In terms of technicality Comprehensive insurance pays damages resulting from events such as natural disasters, theft, vandalism or fire the collision of an animal- in essence, all non-driving related mishaps. Contrary to liability insurance (which is a legal requirement in many states) the coverage of comprehensive is an option. It's not necessarily a bad thing.

Imagine that you park your car in front of a huge oak tree and then over the course of the night, an enormous branch falls onto your windshield. The other car wasn't at fault. Nobody else was to blame. If you were covered by just liability insurance then you'd have to pay from your own pockets. However, with comprehensive coverage your insurance company will help pay repairs after you've met the deductible.

If you're looking for assurance you're protected by your car regardless of where it is parked, or even while you're at your home Comprehensive insurance is the kind of coverage you require. It's a layer of financial protection that shields your vehicle from unexpected incidents.

Drivers often compare comprehensive policies with Collision Insurance to understand which fits their needs.

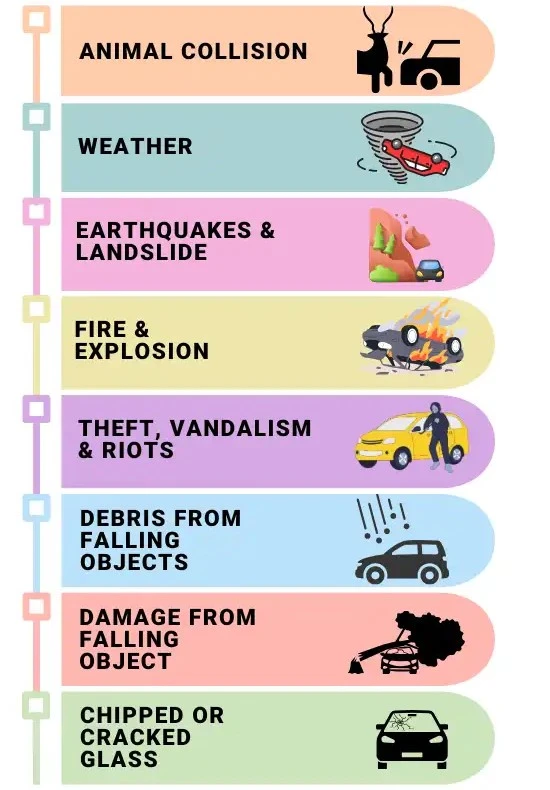

What Does Comprehensive Car Insurance Cover?

Now, let's look at the details. What does comprehensive coverage mean? It might surprise you the extent of coverage it provides.

Here are a few essential things covered by complete insurance:

- Car theft – If your car was stolen, comprehensive insurance assists you in replacing the vehicle or recouping its worth.

- Vandalism – Spray paint, damaged windows, slashed tires? Covered.

- Natural disasters – From the smallest earthquake to flooding, the car you drive is secured.

- Falling objects – Includes trees, signs, or debris that land on your vehicle.

- Explosions or fire – Whether caused by an incident or otherwise.

- Storm damage or hail – Damages caused by weather such as hail or heavy rainfall.

- Accidents involving animals – Did you hit a deer? Comprehensive is there for you.

- Civil disturbances or riots – Damage caused by civil unrest is covered too.

Consider comprehensive insurance as a cover-all for anything other than collision-related damage. It's especially beneficial for people living in areas with violent weather, high crime rates, or lots of wildlife crossings.

Don't forget: if your car is financed or leased, lenders often require comprehensive insurance to protect their investment.

What Damage is Not Covered by Comprehensive Coverage?

Although comprehensive coverage may sound, it's not a magic solution for all problems. There are some crucial excluded areas you must be conscious of. Knowing what's not covered will make a difference in disappointment and possibly a surprise when you need to.

This is a list of things that are generally not covered.

- Accidental damage: When you collide with another car or an object (like walls or poles) and it's not covered by the comprehensive. This is where collision coverage becomes an issue.

- Wear and tear: Normal aging of your car such as worn-out paint, rusty, or worn-out tires aren't protected.

- Mechanical breakdowns: Caused by engine trouble or transmission problems are considered maintenance and not as insurance.

- Accidental or racing-related damage activity: If racing your car, or employing it for criminal activities do not expect assistance from your insurer.

- The personal belongings you have from your car: (like bags or phones) could be covered by the homeowners or renters insurance and not under your car policy.

- Accidental damage: Any harm that you do intentionally causes will not be refunded.

- Repair costs for rental cars: If you don't have insurance for rental reimbursement to your insurance, you'll have to pay from your pocket when your vehicle is at the workshop.

While extensive insurance can cover a vast spectrum of circumstances, it's not completely guaranteed to be bulletproof. When you combine it with collision or other coverages that are optional can provide the most comprehensive protection.

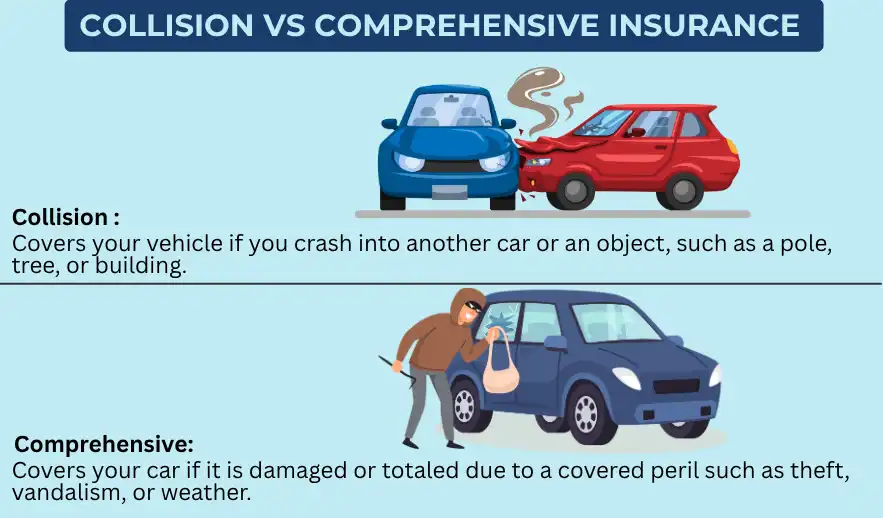

Comprehensive Coverage vs. Collision Coverage

Let's clarify a popular problem: the difference between comprehensive vs. collision insurance. A lot of people believe that they're both interchangeable. However, they're actually very different varieties of risks.

Comprehensive Coverage

We've already discussed how it covers the damage resulting from events that are not collision-related:

- Theft

- Natural disasters

- Fire

- Animal collisions

- Vandalism

- Dropping objects

Collision Coverage

It covers the damage caused by an accident in which your car comes into contact with (or is struck by) other objects:

- If you rear-end a car

- You slide on ice and hit a tree

- A vehicle crashes into your parked car

Here's a simple method to keep it in mind:

- Comprehensive: Things that happen to your car

- Collision: Things that happen while you're driving

What do you pick? Ideally, both — especially if you drive a newer or more valuable car. If your vehicle isn't worth repairing after a major accident, you might opt out of collision but keep comprehensive, particularly in high-risk or high-crime areas.

The best mix depends on your car’s value, your risk tolerance, and what you’re willing to pay out-of-pocket if something goes wrong.

How Does Comprehensive Insurance Work?

The way that insurance coverage is structured helps you handle unpredictable events with confidence. How does the method work once you have filed claims?

It all starts with an accident such as a hailstorm that damages your hood or a limb of a tree falls into your windshield during an icy storm. You first examine the damages, and then call your insurance company to make claims. The majority of insurers allow you to complete this process online, via telephone, or by using an app for mobile devices.

Following is the phase of an adjuster. The adjuster for insurance will look at the vehicle's damage and decide if it's fixable or is a complete loss. They'll estimate the expense for fixing the issue. There's a deductible to pay. It's the amount that you agreed to pay from your pocket at the time you signed in for the plan.

For example, suppose the deductible for you is $500, and repair expenses are $2,000. You'll be responsible for $500, while your insurance company will cover the remainder of $1,500. However, if the repair price is lower than the deductible, then you'll be required to pay the full amount.

In certain cases, your insurance company could decide that your car is in total danger -that is, the price for its repair exceeds the value of its market. If that happens, your insurance company will reimburse you for the market value currently of the car (minus any deductible) and not the amount you spent when purchasing it.

Comprehensive insurance may also cover the cost of a rental replacement while your vehicle is in the shop however only if you've included rental reimbursement protection in your policy. Also, make sure to verify the additional coverages included.

Comprehensive insurance provides peace of mind however it is important to be aware of how the claim and payment procedure works. Knowing the fine print, and knowing the deductible will help you save time and stress in the future.

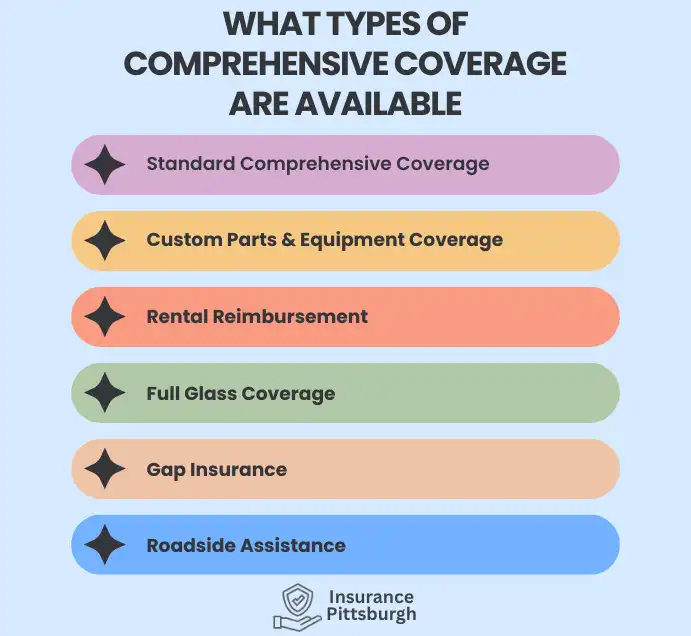

What Types of Comprehensive Coverage Are Available?

There aren't all comprehensive policies that are all-inclusive. Insurance providers typically offer a variety of choices, coverage levels as well as add-ons that allow you to tailor the policy you choose to meet your individual requirements and financial budget.

Below are the most commonly used kinds and variations:

- Standard Comprehensive Coverage

The basic plan is what you get. It includes coverage for non-collision-related incidents like theft, vandalism, natural disasters, and falling objects. It is the type of thing that most people imagine when they think of "comprehensive insurance."

- Custom Parts and Equipment Coverage

If the car you drive is altered (think of custom-designed wheels, body kits or stereo systems), these extras might not be included in the standard insurance. It is possible to add customized parts insurance to safeguard the modifications.

- Rental Reimbursement

If your vehicle is in the garage due to an accident that is covered, a rental reimbursement will help you pay for the cost of renting a vehicle. This is a great benefit when you depend on your automobile on a regular basis.

- Full Glass Coverage

Do you want to cover the cost of the deductible on every damaged windshield? Full coverage for glass lets you fix or replace your auto glass with no deductible. This is especially useful in places that are prone to road debris.

- Gap Insurance

If the car you own is damaged and you have to pay for gap insurance, it covers the gap between the amount you have to pay to the lender on your auto loan, and the value of your vehicle at present. The coverage isn't necessarily comprehensive but it works very well when it comes to new or financed cars.

- Roadside Assistance

Numerous comprehensive policies include an optional extra-service including towing, battery jump-starts and tire repair for flats as well as lockout and towing services.

Every kind of protection is beneficial and gives you security in certain circumstances. Although not every one of them are required, knowing the available options can aid you in making an informed decision. The aim is to design the right policy to protect your car and is compatible with the way you live.

Ready to Get a Free Quick Quote?

When is Comprehensive Insurance Worth It?

It depends on the circumstances. If you own an older car with a low value in the market, purchasing complete insurance might not make economic sense. What's the point of paying for insurance that could just reimburse you just a few hundred dollars?

For newer, more valuable cars, comprehensive insurance is an excellent investment. Also, it is a good idea when:

- You reside in a highly-crime zone

- The area you live in is susceptible to weather extremes (hail and flooding or hurricanes)

- It is possible to park your car on the streets or in unsafe locations

- The past has seen claims made concerning non-collision incident

A lot of lenders demand comprehensive insurance for those who finance or lease the vehicle. If you're looking to keep your credit and lease running smoothly, you'll require the coverage.

If the replacement or repair costs of your car could hurt your pocket, then the cost of comprehensive insurance will be worthwhile.

How Much Does Comprehensive Car Insurance Cost?

Comprehensive insurance is quite affordable in comparison to insurance for liability or collision.

Based on recent data from the industry according to recent industry data, the cost for extensive insurance coverage across the U.S. is about $160-$200 annually. It's less than 20 dollars per month often!

The amount you pay for your insurance is based on things like

- Your car's worth is a function of the price. More expensive cars = greater prices.

- The location of the area - areas with risk of weather or theft might be more expensive.

- Driving record - more claims or violations equals more expensive expenses.

- The amount of deductible you pay - higher deductibles reduce your insurance premium and reverse.

Save money in premiums:

- Bundling of rental or home insurance

- Choosing a higher deductible

- Maintaining a clean driving history

- Setting up anti-theft systems

If you're in need of a strong protection at a reasonable cost the comprehensive insurance package offers excellent value.

Even with comprehensive plans, drivers still look for cheap car insurance in Pittsburgh.

Is Comprehensive Insurance the Same as Full Coverage?

It's a common myth -- they're definitely not exactly the same thing.

Comprehensive insurance is one of the components of what's called "full coverage." It typically consists of:

- Insurance coverage for liability (required by the law)

- Collision coverage

- Comprehensive coverage

Also, having complete coverage doesn't guarantee your rights in the event of car accidents caused by you. The full coverage bundle is one which includes comprehensive and other vital safeguards.

When someone states, "I have full coverage," it usually means they've the three above. Make sure you know what's covered in the policy, especially in the case of purchasing bundles.

Is It Better to Have Comprehensive or Collision Coverage?

It is among the most common questions motorists ask when modifying their auto insurance. Should I choose collision or comprehensive insurance or both? It all depends on the condition of the car you drive, your financial situation and driving habits.

Let's Break It Down:

- Comprehensive coverage guards against other non-collision events like vandalism, theft catastrophes and fallen objects. This gives you peace of mind about any incident that might occur to your car while it's parked or while you're not there.

- The collision coverage is activated the moment your vehicle collides with other vehicles or objects regardless of whether you're the cause or not. If you rear-end into a tree, or get injured at an intersection or slip into a ditch in the winter storm, it's the type of insurance coverage used to pay for the repairs.

You might be considering, "Do I really need both?" This depends on what your car is worth as well as what kind of risk you're exposed to.

When to Choose Comprehensive Over Collision:

- Your vehicle is old and less desirable, yet you live in an area of high crime or extreme weather.

- It is rare to drive, but you want security when your vehicle is sitting.

- It's easier to worry about vandalism or theft than collisions.

When to Choose Collision Over Comprehensive:

- They're often and are more likely to cause an accident.

- It's not possible to cover repairs due to an accident. You'll have to cover it out of your pockets.

- Your vehicle is in a secured area and natural or petty thefts are not common.

When to Choose Both:

- If you own a brand new car or you lease/finance the vehicle.

- It is important to have complete protection regardless of whether it can be attributed to you or not.

- You reside in a place that has high rates of accidents and the weather can pose risks.

The bottom thing to consider? If you are able to afford both, and your vehicle is worthy of repair or replacement, having comprehensive collision insurance is the most effective security net.

Our resource on auto insurance Pittsburgh, PA can help clarify your options.

Should I Get Comprehensive Coverage or Liability Coverage?

If you're trying to decide between liability and comprehensive coverage It's important to know that both serve distinct functions. And in several states it is required to carry liability insurance in law.

Liability Coverage:

This is the minimal amount that is required by most states. This only covers:

- You cause damage to vehicles of other motorists or other property.

- The cost of medical treatment for anyone else hurt in accidents you've caused.

The insurance does not protect your car, or injury.

Comprehensive Coverage:

This is optional and protects your own car from non-collision-related events like theft, fire, floods, vandalism, and more.

This is where it gets intriguing: comprehensive insurance for you, whereas liability provides protection to everybody else.

If you're driving around in a car that's worth $1000 and you're a safe driver who lives in a secure neighborhood and you're a responsible driver, perhaps just liability is sufficient. If you're parking in areas that aren't safe or experienced close calls due to hailstorms, or even deer, insurance coverage could help you avoid enormous, unanticipated expenses.

So, Which One Should You Get?

- Take out liability insurance if you're trying to keep your costs at a minimum and your vehicle doesn't have much value.

- Include comprehensive insurance: In the event that you're facing financial stress in the event of replacing or repairing your vehicle due to storm damage, theft or vandalism.

- Be aware of your liability. This is required by law and is essential in order to shield yourself from criminal penalties.

A lot of drivers choose to have both -- liability in order to keep themselves legal while protecting other drivers, as well as comprehensive protection against unforeseeable circumstances.

FAQs

1. What's the difference between full coverage and full coverage?

Comprehensive is just one aspect of the full coverage. The term "full coverage" usually refers to comprehensive, collision and liability insurance. In other words, the mere fact that you are covered by comprehensive does not mean that you've got the full coverage.

2. Can I resign from my coverage at any time? at any time?

Since it's an option You can take it off at any point. If your car is loaned or purchased, your lender could have you keeping that vehicle till the debt has been taken care of.

3. Does insurance that is comprehensive provide coverage for rental cars?

This is not automatic. Rent reimbursement is an additional addition. If you cause damage to the rental as a result of the event that is covered, the policy you have in place could apply and you should consult your insurance provider.

4. Does comprehensive insurance increase my cost?

This could slightly raise the cost of insurance, but generally, it's quite inexpensive. A majority of motorists pay less than $200 per year for complete insurance.

5. What's the average deductible for all-inclusive insurance?

Deductibles can be between $250 and $1,000. A higher deductible reduces the amount you pay, however it means that you'll have to pay higher out of pocket should you need to file an insurance claim.

Conclusion

In the conclusion of the day comprehensive insurance for cars will provide safety and security. It's for what-ifs such as the fallen tree and the hailstorm that lands and the burglar who gets into. Although it's not able to cover all scenarios, it plays an important part in protecting your vehicle against the unforeseeable even while you're not at the steering wheel.

Selecting the best coverage mix that includes collision, liability and comprehensive will depend on the worth of your car and your cushion for financial risk as well as your personal preferences. If you're seeking protection that goes above and beyond the basic, comprehensive insurance is an excellent investment.

When you're evaluating your insurance policy, don't only mark the boxes. Take a look at where you reside, where you live, the way you park as well as what the car represents to you. In the field of insurance for cars it is the "extras" that are sometimes the most significant components.