Speeding Ticket Car Insurance – How a Ticket Affects Your Rates

Table of Contents

- Does a Speeding Ticket Affect Your Insurance?

- How a Speeding Ticket Can Affect Your Insurance

- How Much Does Insurance Go Up After a Speeding Ticket?

- When Will a Speeding Ticket Show Up on Insurance?

- How Long Does a Speeding Ticket Stay on Your Driving Record?

- Will a DUI Make My Premium Go Up?

- Will a Parking Ticket Make My Premium Go Up?

- When Will My Premium Go Up After a Violation?

- How to Save on Car Insurance After a Speeding Ticket

- Speeding Ticket Car Insurance — FAQ

- Related Articles

Does a Speeding Ticket Affect Your Insurance?

Answer in a short time? Yes. Speeding tickets can definitely affect your insurance rates. However, how much or quickly it will happen really depends on a handful of key variables.

When you enroll to insure your car in essence, you're entering into the terms of a risk contract. Insurance companies look at your driving record along with your age, model of car along with your current location to decide your risk to take on. Clean driving records tell that you're not a risky driver, and the reward is reduced costs.

If you do get a speeding ticket, your clear slate will be marked. The severity of the offense is, for instance 10, mph above the speed limit, versus 25 mph -- it could put you in the riskier category. For insurers, higher risk means more.

Certain insurance companies may not raise your rates even after a minor infringement particularly if you've got an extensive history of secure driving. Many are likely to raise your rates. Indeed, just one ticket could increase your rates by hundreds of dollars every year. According to NerdWallet's research the average nationwide price increase for a single ticket for speeding is around 25%, and in certain cases, greater.

If you don’t own a car but still drive, it’s smart to look into Non-Owner Car Insurance Coverage.

How a Speeding Ticket Can Affect Your Insurance

There's more to it than the cost or embarrassment when you're caught. The speeding ticket left digital footprints on your driving record as well as on your insurer's databases.

Insurance companies use these data in order to evaluate your risk each time you are due for renewal. If they find the speeding penalty it could be a sign that you're more likely involved in an accident. It's simple logic that risky drivers make more claims, and those claims can result in a cost.

If you get multiple tickets within a relatively short time, you may be categorized as a high-risk driver. This puts you into a situation wherein fewer insurance companies would like to work with you. Those that offer it will have to pay a higher rate for this privilege.

Insurance companies also consider the speed you were traveling at and the speed you went at. Did you speed through an area for school? Are you five mph or 30 mph faster than the speed limit? Those details matter. The consequences of a reckless driving offense or an excessive speed violation can cause a greater increase in the rate of traffic violations more than an incident that was minor.

How Much Does Insurance Go Up After a Speeding Ticket?

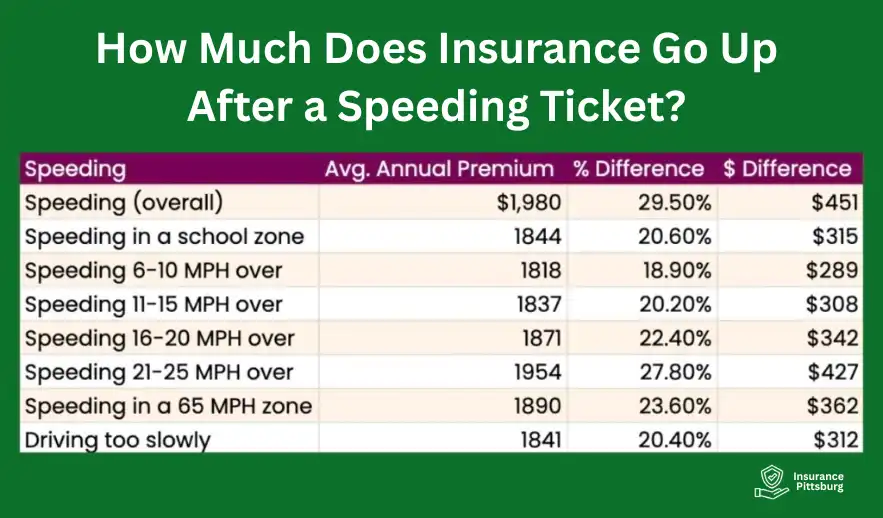

Let's take it apart with some figures. Although the precise amount will vary according to state and insurance company there are some common tendencies:

- Speeding that is minor (1-15 miles per hour): The premiums could be increased by 10% to 20%.

- Moderate speed (16-30 miles per hour over): It is possible to see an increase of 20-30%.

- Excessive speeding (30+ mph or more): The rate could increase at least 40%.

If you're already paying an excessive premium because of age (like teenager drivers) or prior lawsuits, a citation could increase your premium by several hundreds of dollars per year.

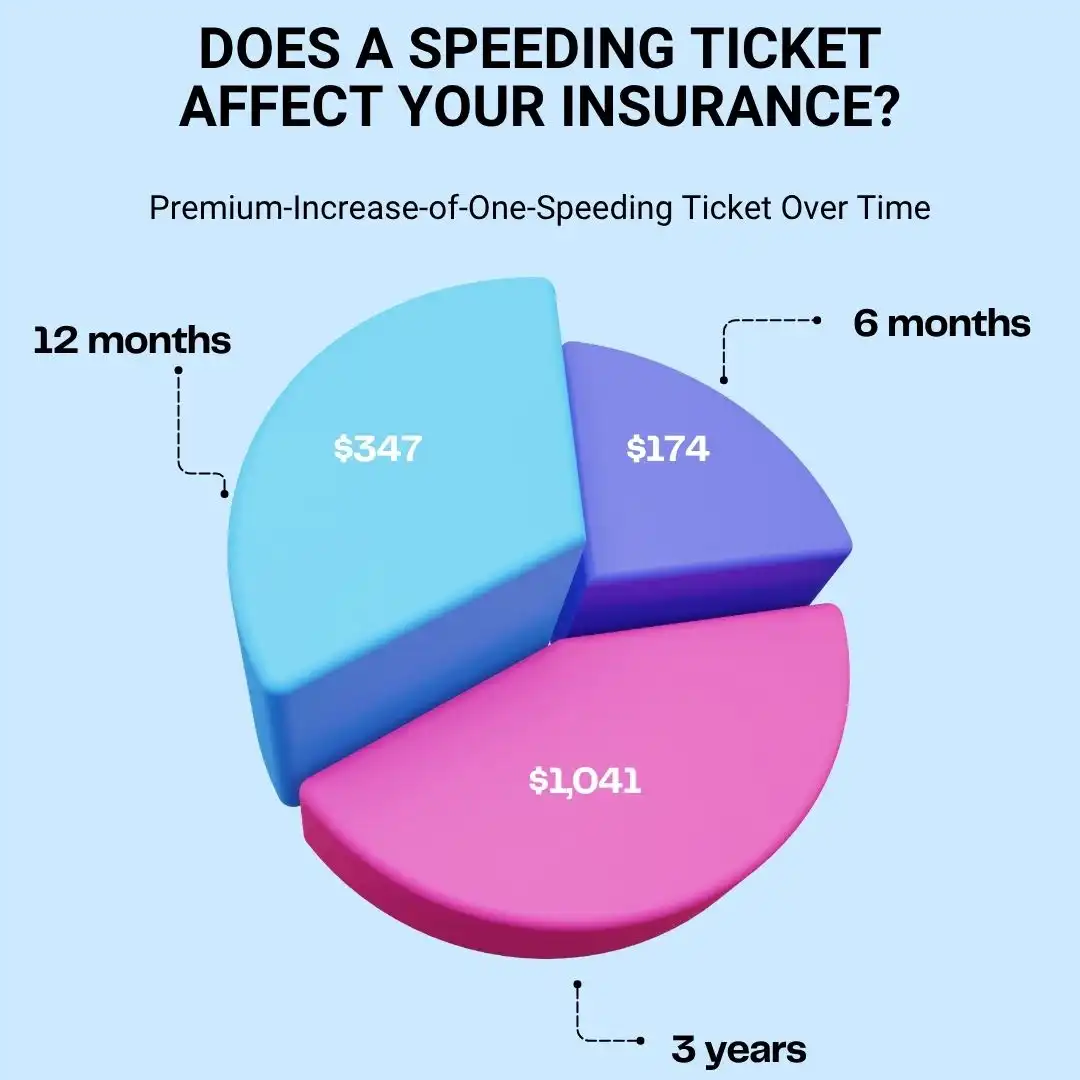

According to Progressive and Allstate one ticket can increase your premium between $1,500 and $1,850, a variation of around $350 annually and a little more than $30 a month. In three years, this amounts to more than $1,000 more from your pocket.

When Will a Speeding Ticket Show Up on Insurance?

Do you want to know how soon your insurance provider will be able to tell you that you have tickets? There's no instant notification and it's also not accommodating either.

Most of the time, when you're given an infraction for speeding, it will be reported to your State's Department of Motor Vehicles (DMV). After that your insurance provider can access this public record. Usually, you're due to renew your coverage or when you request an additional quotation.

The rate will not increase the following day. If your renewal is due at the end of 6 months or one calendar year, you shouldn't be shocked to find that the cost is slightly higher. Insurance companies may examine your driving history often, particularly when you've experienced issues with your driving record in the past. Some only check it during the renewal date.

What's the quick version? It's possible that your ticket won't hit your insurance immediately However, it's certain to be there.

Speeding tickets don’t stop you from comparing the cheapest car insurance Pittsburgh.

How Long Does a Speeding Ticket Stay on Your Driving Record?

Here's the kicker: How long will that one mistake last?

The majority of states will keep the speeding tickets in your file for a period of 3 to 5 years. However, that doesn't guarantee that your premiums are going to remain high for the entire period. A lot of insurers punish drivers for around three years following the issuance of a ticket. After which, your rates could begin to decrease, assuming that there's no further infractions.

A few states have a point system linked to violations. As an example, California awards 1 point to minor speeding, and two points for serious offenses. Inflict excessive points, and you risk licensure suspension and not only increased prices.

What's the main takeaway? This ticket resembles an unintentional tattoo. The tattoo fades with time however, it won't go away overnight.

Will a DUI Make My Premium Go Up?

Yes, absolutely. And not just an inch. A DUI (Driving under the influence) is among the most serious of offenses that you could have in your driving record and insurers view the offense as a major warning. If you are thinking that an incident of speeding increases your insurance premium, you should take a look at the impact of a DUI.

A typical DUI will increase your auto insurance rates by up to 50% up to 100 percent, or more. Indeed, certain insurers may cancel your insurance completely following an DUI which will force you to choose a high-risk insurance provider that has significantly higher costs. This is due to the fact that the conviction of a DUI is a sign of impaired judgement and an increased risk of being involved in an accident that makes you a highly costly risk to cover.

It's not only all about the cash. A DUI conviction is often accompanied by the SR-22 requirement, which is a specific certificate that the insurer must provide to the state of Georgia in order to show you've got sufficient liability insurance. There are a few companies that provide SR-22 insurance. This limits the options for you even more.

This is a brief overview of what you can expect following the occurrence of a DUI

Learn how tickets affect premiums in our page on car insurance in Pittsburgh, PA.

- Your current insurer might cancel your policy.

- If they do not for a long time, you can expect your rates to rise by a third or even triple.

- It is possible that you require SR-22 approval for a period of as long as 3 years.

- The information will remain on your file for 5 to 10 years, according to your state.

In the end, A DUI is not just an accident, it's an expensive, lengthy cost in the field of car insurance. Beware of it at all costs.

Will a Parking Ticket Make My Premium Go Up?

There's a good thing about this: parking tickets aren't directly affecting your insurance rates for cars. Contrary to reckless driving, speeding or even a DUI, parking violations are not traffic offenses. Insurance companies do not consider them in their risk calculations because they don't signify poor conduct.

Don't forget about these tickets. Parking tickets that are not paid can create more problems:

- A few states might cancel your registration for your vehicle.

- Invoices that have not been paid may be sent to collections and can damage your credit score.

- The accumulation of too many tickets may make you look unfavorable if switching insurance companies.

In the majority of cases, you won't need to fret about a $50 parking ticket causing your insurance to go up. It's a good idea to get them paid promptly, not let them accumulate, and be assured that you won't see your insurance premiums skyrocket.

Imagine it in this manner: Insurance firms care more about how you drive rather than where you park your car.

When Will My Premium Go Up After a Violation?

You got an infraction for speeding last week. Should you prepare yourself for an instant rate increase? Not quite.

Most of the time, you won't see your premium increase until the next renewal, which typically happens every six or 12 months.

The typical scenario is:

- The offense is registered with the state's DMV.

- The insurance company pulls your driving history at the time of renewal.

- If they find an infraction, they will reassess your risk and increase your premium.

Minor speeding tickets: rate increase usually kicks in with the next renewal.

Serious violations (DUI or reckless driving): Possible immediate impact, including potential cancellation.

This means that there's usually a delay between the time of your ticket and when you feel the consequences. It might seem like the punishment is delayed, but rest assured—it’s very real. Insurance companies may also conduct periodic reviews that aren’t tied to renewal dates. This is especially common after a claim or if you've recently changed your policy.

If the offense is serious enough—like a DUI—your insurer may reevaluate your policy mid-term. In extreme situations, they might even cancel it entirely.

Here’s an easy timeline:

- Minor speeding tickets: Rate increases usually kick in at your next policy renewal.

- Serious violations (DUI or reckless driving): These may have an immediate effect and could even result in cancellation of your policy.

Some insurance providers do offer forgiveness programs—we’ll cover that more below. But don’t count on forgiveness if you’ve already had multiple violations. Each new incident makes it harder to avoid a rate hike.

Ready to Get a Free Quick Quote?

How to Save on Car Insurance After a Speeding Ticket

You've got the ticket. What now? It's not necessary to do nothing and accept your higher rates. There are ways you can lower your expenses and gain the reins of your insurance.

1. Shop Around for New Quotes

Your current insurer raising your rate doesn’t mean all will. Compare quotes from at least 3–5 providers using comparison tools or brokers. Risk models vary widely.

2. Take a Defensive Driving Course

Certified courses ($20–$50) may knock 5–10% off your premium and show insurers you're a responsible driver.

3. Ask About Forgiveness Programs

Many insurers offer accident or ticket forgiveness for first-time infractions, especially if your driving record is clean. Just ask—you might be surprised.

4. Raise Your Deductible

Boosting your deductible to $1,000 reduces your monthly premium. It's a smart tradeoff if you don’t claim frequently.

5. Bundle Policies

Bundling auto with renters, homeowners, or life insurance could trigger discounts of up to 25%.

6. Improve Your Credit Score

In many states, credit score influences your premium. Pay down debt, avoid late payments, and monitor your report for a healthier rate.

7. Drive Less or Use Telematics

Low-mileage and safe driving tracked through tools like Snapshot (Progressive) or Drivewise (Allstate) can lead to big savings—even post-ticket.

8. Wait It Out

Speeding tickets usually fall off your record in 3 years. Drive cleanly until then, and mark your calendar to reshop policies after it expires.

Speeding Ticket Car Insurance — FAQ

Q: Does an incident with a speeding fine automatically raise the price of car insurance?

It's not always automatic however, in the majority of cases insurance companies see the speeding ticket as a sign of increased risk. They could increase the cost of your insurance.

Q: Does a speeding ticket impact my insurance premiums?

Insurers usually increase rates due to speeding violations that indicate unsafe driving and could cause higher insurance claims.

Q: Are all speeding tickets considered equal by insurance firms?

No, the factors such as the speed that you exceed the limit, the number of previous infractions, as well as the policy of your insurer affect how much your insurance rates increase.

Q: Does a first ticket for speeding influence my insurance?

Sure, an initial ticket may result in higher rates however the cost could be lower than when you have several infractions.

Q: For how long will the speeding penalty have an effect on my insurance costs?

Generally speaking, insurers look at tickets that last 3 to 5 years in making their prices.

Q: Am I able to avoid an increase in my rate after the issuance of a speeding ticket?

In some cases, through enrolling in a defensive driver course and maintaining a clean driving record or changing insurers you could limit or eliminate the cost of premiums.

Q: Will the severity of the violation result in a reduction in my insurance?

Sure, but going only a couple of miles over the speed limit could have less of an impact than speeding or reckless driving tickets.

Q: Does every state send speeding tickets to insurance firms?

Most states send tickets with the DMV and insurers have access to however reporting deadlines and guidelines vary from state to state.

Q: Does an incident with a speeding fine affect insurance coverage for drivers younger than 25 in a different way?

Drivers who are younger are more likely to be at risk because they have generally more risk profile.

Q: Should I look for new insurance in order to obtain the best rate after getting the speeding penalty?

Yes, all insurers evaluate violations differently and comparing prices will help you locate cheaper rates.

Conclusion

A speeding ticket is more than just a fine — it can follow you for years through increased insurance premiums and limited policy options. While the actual impact depends on the severity of the violation, your past record, and your insurer’s policies, it’s clear that even one ticket can cost you more than expected.

The good news is that there are proactive steps you can take to reduce the financial blow. From shopping around for quotes to taking defensive driving courses or using telematics, staying informed and responsive can save you hundreds — even thousands — over time.

Above all, the safest and most affordable strategy is also the simplest: follow speed limits and practice responsible driving. Not only will your wallet thank you, but so will everyone you share the road with.