Non-Owner Car Insurance

Table of Contents

- What is Non-Owner Car Insurance?

- How Does Non-Owner Car Insurance Work?

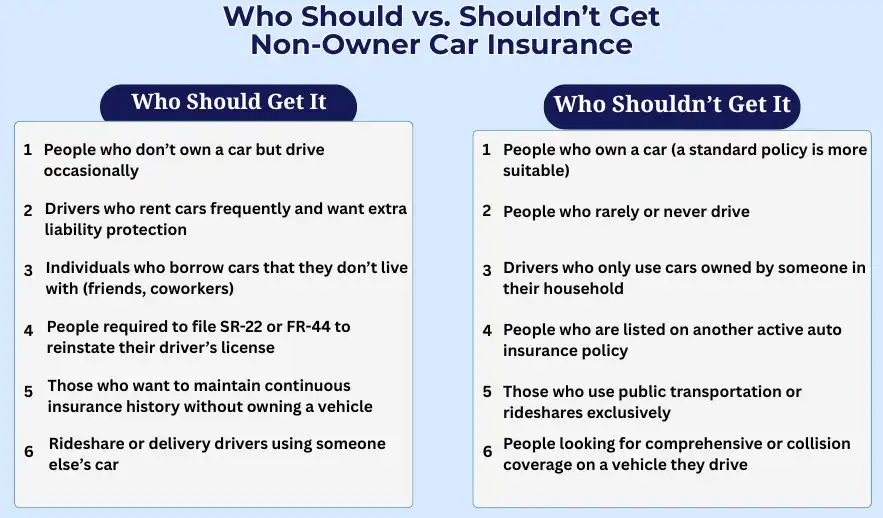

- Who Should Get Non-Owner Car Insurance?

- Who Shouldn't Get Non-Owner Car Insurance?

- What Does Non-Owner Car Insurance Cover?

- What Does Non-Owner Car Insurance Not Cover?

- How Much Does Non-Owner Insurance Cost?

- Non-Owner Car Insurance FAQs

- Related Articles

What is Non-Owner Car Insurance?

Definition and Purpose

Non-owner car insurance is a special policy created specifically for those who operate automobiles they do not possess. The type of insurance offered is the protection of liability, meaning that it will cover the expenses related to bodily injuries and property damage that you might cause others during accidents while driving a vehicle that you don't have. This is a great option for people who often lease cars or vehicles from relatives or friends or utilize car sharing services.

Key Features

- Liability Protection: Guards against expenses arising from injuries and damage you cause others.

- Secondary Coverage: Functions as an additional insurance policy to the owner's insurance primary, covering the cost of excess.

- There is no requirement for a vehicle owner: This is a tailored option for those who do not own any personal vehicles.

- Cost-effective: Usually less than the standard insurance policies for autos.

How Does Non-Owner Car Insurance Work?

Primary Secondary. Secondary Coverage

If you're driving a car that you do not own, the insurance policy of the vehicle is to be the principal protection. In the event of an accident, the insurance policy of the owner will pay for the damage up to the limits of its policy. The non-owner insurance policy acts as a secondary insurance, filling into the gap to pay any expenses that are beyond the owners insurance limits.

Policy Activation and Use Cases

- Car Rentals: Offers protection against liability beyond that which rental companies provide.

- Cars borrowed from a borrower: Provides extra safety when driving a different vehicle.

- Car-Sharing Service: Ensure that you're protected when you use services such as Zipcar and Turo.

For those seeking full protection instead, see how Full Coverage Car Insurance compares.

Who Should Get Non-Owner Car Insurance?

Frequent Car Borrowers

If you frequently borrow vehicles from relatives or friends, getting your own personal Non-owner insurance will ensure that you're safe regardless of the car's insurance policy.

Regular Car Renters

If you rent vehicles frequently, insurance that is non-owner by the owner is more affordable as compared to purchasing liability insurance at rental firms every single time.

Individuals Requiring SR-22

People who require an SR-22, usually because of previous driving offenses and/or insurance coverage for non-owners for state-specific requirements, with no vehicle.

Even non-owners can shop for policies that count as cheap car insurance Pittsburgh.

Who Shouldn't Get Non-Owner Car Insurance?

Car Owners

If you have a vehicle then a basic auto insurance policy would be more suitable since it will cover damages to physical as well as liability to your car.

Household Car Users

Anyone who uses vehicles that are owned by a member of the household must be included as owners on the insurance policy, instead of buying additional insurance for the non-owner.

Infrequent Drivers

If you don't drive often and do not own a car, the expense of owner insurance isn't worth the cost. It's cheaper to rely on the insurance of the owner, or to purchase insurance on a need-to-know basis.

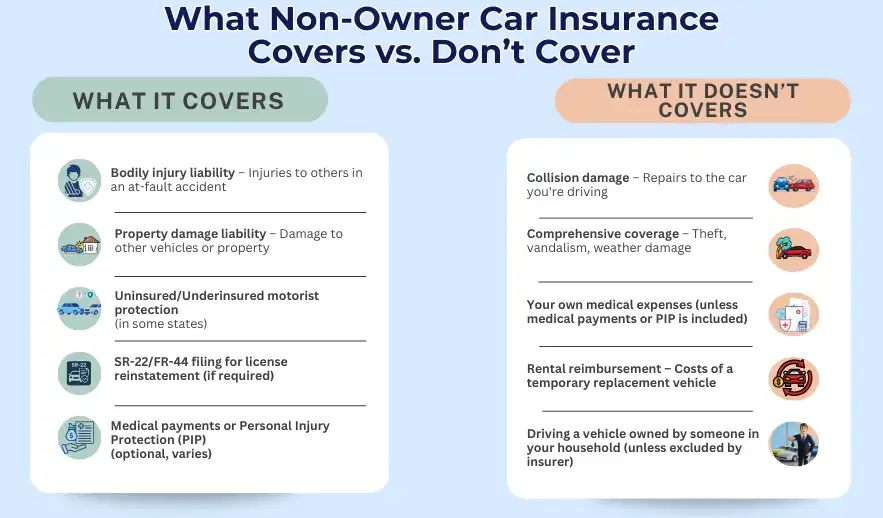

What Does Non-Owner Car Insurance Cover?

Liability Coverage

- Accidents to the Bodily: medical costs for injuries caused by other people.

- Property Damage: Costs for repairing or replacing the property that you have damaged.

Uninsured/Underinsured Motorist Protection

It provides coverage in the event that you are involved in an incident with a driver that is not insured.

Medical Payments or Personal Injury Protection

Insures medical costs regardless of the person responsible for an accident.

What Does Non-Owner Car Insurance Not Cover?

- Physical Damage to the Vehicle: The non-owner's insurance does not cover damage caused to the vehicle you're driving. Insurance for the owner or an additional collision damage waiver will be necessary for that.

- Personal Belongings Inside the Vehicle: Car-related items including laptops, phones or computers don't fall under the policy that doesn't cover non-owners.

- Other Drivers: The policy you have purchased will only cover only you. If a third party is driving the vehicle, then the insurance for non-owners won't be applicable.

See how non-owner policies compare in our resource on auto insurance in Pittsburgh.

How Much Does Non-Owner Insurance Cost?

Average Cost Estimates

Costs vary, but usually are between $200 and $500 each year. The factors that affect the price include the history of your driving, where you live and the type of insurance you select.

Factors Influencing Cost

- Driver Record: A clear driving record will lower the cost of insurance.

- Location: Rates for insurance differ according to state.

- Limitations on Coverage: Greater limits result in higher premiums.

Non-Owner Car Insurance FAQs

Can You Get Car Insurance Without a Car?

The insurance offered to non-owners permits people who don't own a vehicle to get liability insurance in the event of driving vehicles they don't have.

Besides Liability Insurance, What Else Does Non-Owner Car Insurance Cover?

Some policies may include uninsured/underinsured motorist protection and medical payments coverage, but they typically don't cover physical damage to the vehicle.

What is a Non-Owner Insurance Policy?

This is a liability insurance plan that covers drivers who don't have a car that provides protection when driving cars they do not own.

Do you have the ability to drive without Car Insurance?

Yes, it offers the required liability insurance for driving a vehicle that isn't yours, which means that you are protected in the event of an accident.

Where Can I Get Non-Owner Car Insurance?

Numerous major insurance providers provide non-owner insurance. It's advisable to compare quotes and coverage options from insurancepittsburgh.us which is so affordable.

Conclusion

Non-owner car insurance is a valuable option for those who frequently drive vehicles they do not own. It provides essential liability coverage, ensuring that you are protected in case of accidents. However, it is important to understand its limitations and when it is appropriate to use this type of insurance.