Car Insurance in Pennsylvania is a major cost for drivers, and knowing the elements that affect premiums can assist you in making an informed decision. The year 2025 will see a variety of factors including the location, the age of your driver, location and credit score will be crucial in determining your rates. In this article, we will look at the particulars of the cost for car insurance for Pennsylvania in the year ahead.

| Coverage Options | PA Average Rate | National Average Rate | Percentage Difference |

|---|---|---|---|

| Full Coverage | $1,339 | $1,296 | 3% |

| State Minimum Liability Only | $460 | $595 | -23% |

Minimum insurance coverage for Pennsylvania generally comes with liability insurance. This protects others from damages from accidents that you create. By 2025, the median cost of minimum coverage will be around $1,050 annually.

As a per-month basis motorists across Pennsylvania are charged an average of $199 to get complete coverage, and $97 for liability only policies.

Costs can vary widely by age, which is why many people look into Cheap Car Insurance for Young Adults.

The cost of car insurance in Pennsylvania will vary depending on many aspects, such as the location you live in, your driving record and the amount of protection you select. Knowing the cost average can assist you in making informed decisions when choosing the right insurance plan.

Full coverage: The annual average cost for full coverage auto insurance for Pennsylvania is about $1,339 which is a little higher than the average national rate of $1,296.

Minimum coverage: For the state minimum liability insurance, the median annual cost is approximately $460 that is less than the average national figure of $595.

A variety of factors can contribute to the variance in insurance rates in Pennsylvania:

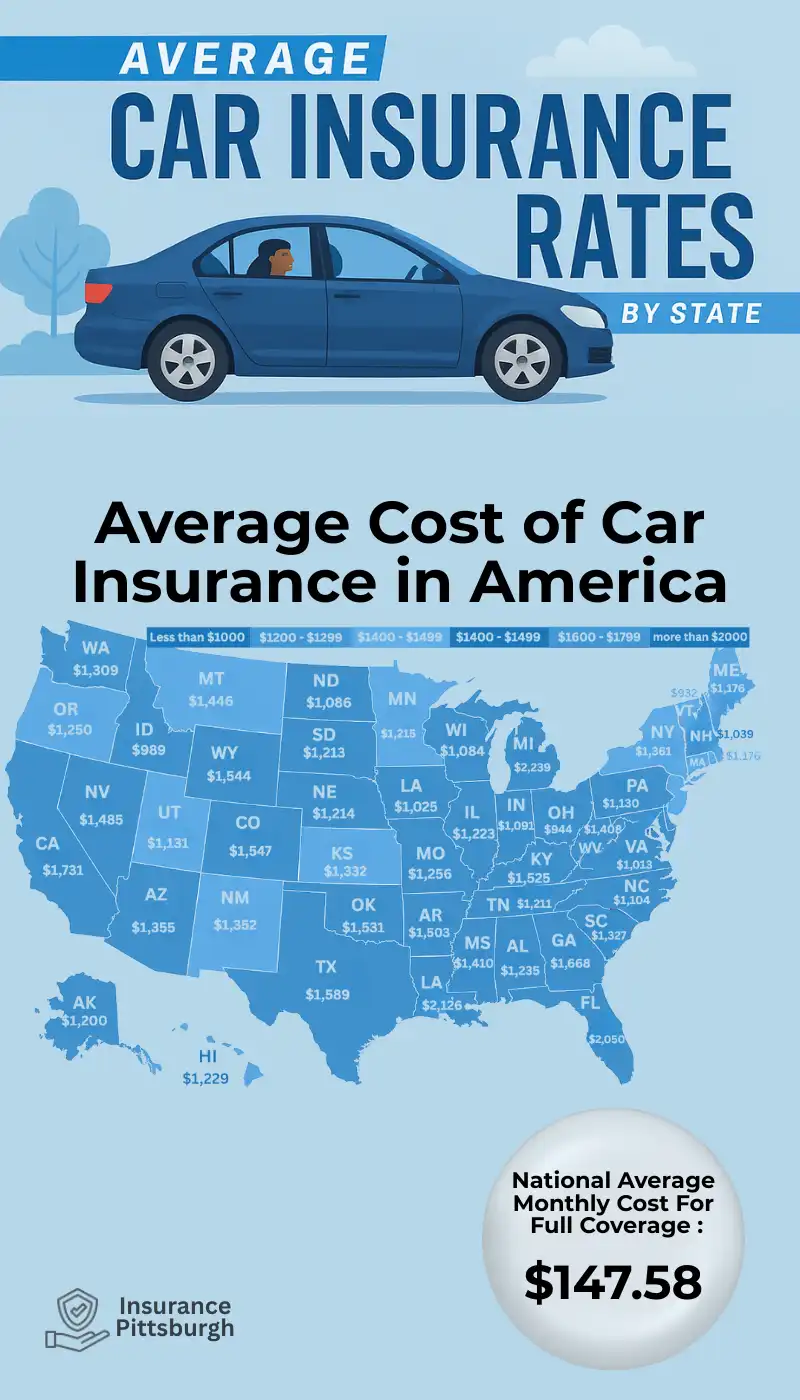

If you compare it to other states, Pennsylvania's typical car insurance rates are moderate.

In the event that you can cut down on the cost of car insurance in Pennsylvania:

Understanding the average cost of car insurance within Pennsylvania and the factors that impact them, you will be able to make educated choices to ensure the best coverage for your budget.

Premiums for insurance may vary greatly according to the location of where you live. In this case, for example:

Pittsburgh: Car insurance rates in Pittsburgh, Pennsylvania, tend to be more affordable compared to other major cities in the state. On average, drivers in Pittsburgh pay around $1,300 to $1,600 annually for full coverage, depending on their driving history, age, and vehicle type. Several factors influence premiums in the area, including traffic density, accident rates, and local crime statistics. Pittsburgh's moderate population size and relatively low incidence of severe weather events contribute to more favorable insurance costs. Additionally, policy discounts for safe driving, bundling home and auto, and maintaining a clean driving record can help reduce premiums even further.

Philadelphia: Philadelphia is the most expensive city in the United States; motorists have to pay an average of $4,163 each year to get full insurance.

Walnut Bottom: One of the areas that is more affordable with average annual costs about $1,753.

These variances are influenced by things like the density of people living there, traffic conditions, and the local rate of accidents.

| City | City Full Coverage | Vs. State Average | City Minimum Coverage | Vs. State Average |

|---|---|---|---|---|

| Allentown | $1,073 | -44% | $437 | -60% |

| Philadelphia | $1,868 | -2% | $772 | -30% |

| Pittsburgh | $1,093 | -43% | $423 | -61% |

The gender and age of the person are major factors in the cost of insurance for cars:

Young drivers (16-24 years): Typically pay greater rates due to their inexperience. For instance, males who are 16 are paid around $7,530 per year, and females are paid around $6,742.

Middle-aged drivers (40 years old): Benefit from lower prices for both genders, paying around $1,895 per year.

Senior Drivers: Rates could be higher due to issues like a slower reaction rate and physical health issues.

Premiums for females and males is evident in older drivers however they can be even with advancing older.

| Age | Male | Female | ||||

|---|---|---|---|---|---|---|

| Individual Premium | Family Premium | Increase % | Individual Premium | Family Premium | Increase % | |

| 18 | $3,066 | $1,690 | -45% | $2,702 | $1,601 | -41% |

| 19 | $2,377 | $1,794 | -25% | $2,119 | $1,621 | -24% |

| 20 | $2,132 | $1,613 | -24% | $1,978 | $1,530 | -23% |

For a broader view of coverage types, see our page on Pittsburgh auto insurance.

Your driving history is an important factor when it comes to the determination of insurance rates. An excellent driving record could result in lower rates, but violations may increase your costs.

Accidents: In the event of being at fault for an accident could increase the cost of your insurance by 20 percent or 50%.

Tickets for speeding as well as other offenses could result in higher charges.

The driving of each year for longer distances increases your risk of possible accidents and leads to higher insurance premiums.

Insurance companies that offer low mileage provide discounts to drivers who have low annual mileage.

A clean driving record and cutting down on unnecessary driving could aid in reducing insurance costs.

The credit score of yours doesn't only determine your eligibility for loans, but it also plays an important part in the amount you'll pay for auto insurance in Pennsylvania. Insurers typically utilize an "credit-based rating" to determine the probability of you submitting claims.

This is how it works:

This is due to the fact that insurance companies link their financial accountability with the possibility that comes with filing claims. Although this is a controversial practice however, it's legal and widely practiced throughout Pennsylvania.

It's a common desire to save money. This is especially true with regards to auto insurance. There are effective and smart strategies to cut down on your car insurance costs in Pennsylvania.

Insurers provide a range of discount options that you could be eligible for, without knowing:

Ask your insurance provider about any discounts they might offer. It can save you hundreds of dollars.

The amount you spend out of your pocket prior to when insurance starts to take effect - could significantly decrease your cost.

Examples:

It's not a great chance, but when you're a responsible driver it usually pays back in the long term.

There are times when drivers are not adequately insured. Check your coverage

By cutting these costs, you can cut some dollars off your monthly bills.

The less you travel and the less you risk, so will the lower your insurance. Consider:

Numerous insurance companies offer discount rates for low-mileage drivers that are available to drivers who commute less than 7,500 miles in a year.

Although it may sound obvious yet safe driving will save your costs in more ways than just one. Apart from avoiding accidents expenses, you also:

Many insurance companies offer the telematics device that monitors your driving patterns. Drivers who are safe can get discounts as high as 30 percent.

Like we said earlier, a higher credit means lower premiums for insurance. This is how you can boost your credit score a boost

The process of improving your credit can take time however it pays dividends in many areas of your finances.

Avoid sticking with the same insurer because of a routine. The prices vary between different insurers with the same profile of driver. In the course of a year or two take a look at quotations from three companies. Make use of online tools to compare prices or call the independent agents to get help.

Some drivers don't realize they are paying too much for insurance they don't really require or that could be cheaper in other places. Retrospectively checking your policy, as well as keeping yourself informed of current rates will assist you in staying ahead.

If budget is your main concern, check out ways to secure the cheapest car insurance in Pittsburgh, PA.

Pennsylvania is one of the states that is a "no-fault" state. That implies that the insurance you have will be able to cover medical expenses, regardless whether the cause was your fault. The minimum insurance protection required by law:

| Coverage Type | Average Annual Cost | Average Monthly Cost |

|---|---|---|

| Minimum Coverage | $1,050 | $87.50 |

| Full Coverage | $2,386 | $199 |

Costs for car insurance in Pennsylvania are a bit different based on factors such as your time of birth, where you live, your the history of your driving, or even the credit rating. The average price for full coverage is at around $2,386 per year, however your exact rate may vary significantly, or even greater.

The good news is that You have a lot more control on the cost of your insurance than you realize. Through shopping around, keeping an impeccable driving report, improving your credit score and making use of discounts that are available it is possible to reduce your costs by hundreds, or even thousands every year.

Don't settle for the first price you receive. Do the research, check out quotes, and ensure you're paying the right amount to insure your car in Pennsylvania.