Car Insurance for Drivers With Bad Credit

Table of Contents

- Car Insurance for Drivers With Bad Credit

- Auto Insurance policies for drivers who have Bad Credit

- How Your Credit Score Affects Your Insurance Rate?

- Average Car Insurance Rates Across Credit Tiers

- How to Improve Your Credit Score?

- Car Insurance Discounts for Drivers

- Car Insurance Credit Score FAQs

- Conclusion

- Related Articles

We'll be honest -- being a credit card holder can be like a cloud of rain that can be seen everywhere. And you can affect your insurance rates for cars. If you've received an astronomical price for automobile insurance, your credit score may be the cause. However, here's the good news: there's no need to worry. There are solutions to deal with this.

Insurance providers for car insurance don't simply examine how you drive. They're considering how you handle your finances. It may sound odd however to them, your credit score can tell an entire tale. Low scores can indicate greater risk even though you've not had any accidents. It's why drivers with bad credit are often paying hundreds of dollars higher in annual fees than drivers who have excellent credit scores due to a score.

Are they fair? It depends on who you are asking. Insurance companies argue that the statistics prove the connection between lower credit levels and greater claims rates. Some critics believe it is penalizing those who are financially in danger. A few states, like California or Hawaii have stepped up and banned the use of credit scores for the pricing of car insurance.

If you're among the many millions of Americans with an average score, don't be worried. There are still options. There are insurance companies that are specialized in dealing with drivers who are credit challenged. There are also effective strategies to reduce the costs.

Let's look at your top options, the things you can expect as well as how you can make sure you have more money in your pocket regardless of what your credit rating is.

Bad credit isn’t the only challenge—violations matter too. See the differences explained in DWI vs. DUI: What’s the Difference?.

Auto Insurance policies for drivers who have Bad Credit

If your credit score isn't as good the options for automobile insurance could be a bit restricted, however, they're not completely nonexistent. Many companies are changing to offer more comprehensive, scalable coverage to people with bad credit. The trick is to know which areas to search for and what you should look for.

And, what kinds of policies are available? The most common kinds:

- Liability Insurance: Covers damages or injuries caused to another person when you're responsible for an accident.

- Collision Insurance pays for the damage caused to your vehicle by an accident.

- Comprehensive Insurance: Covers the weather, theft, and fire damages, as well as other events that are not collision-related.

For those with poor credit, these policies are typically the least expensive. However, being cautious selecting the cheapest premium could result in lower insurance protection. If you depend upon your car for business or for family reasons, skipping on protection could end up costing you more in the end.

Then it becomes fascinating: certain insurance companies are actually specialized in helping high-risk or low-credit drivers. The companies such as Acceptance Insurance, The General, and Dairyland have a reputation for providing affordable policies. Based on Acceptance Insurance, they design programs for people who've previously been refused elsewhere. Some, such as The Zebra and Bankrate, advise shopping around and comparison of quotes. You'll be amazed at how much rates could vary even with the same coverage.

However, what are you seeking? You should focus on:

- Flexible payment plans

- Options for SR-22 (if you require)

- Discount opportunities

- The reputation of customer service

A tip for you: Even when your credit score isn't the greatest, don't think you're locked in one insurance firm. Utilize online tools for comparison to locate and compare auto insurance policies for those with poor credit across your local area. There is a chance to find a bargain that is a good fit for your budget as well as your lifestyle.

How Your Credit Score Affects Your Insurance Rate?

You're wrong. Insurance companies use the credit-based insurance score and it's an important factor in the amount you are charged for insurance coverage on your car.

The thing is that this score doesn't have the exact same characteristics that the FICO score. This is a specific version for companies that offer insurance. It weighs the following things:

- History of payments

- Outstanding debt

- The length of credit history

- Credit types

- The new credit activity

Why is it important to the people who have it? According to insurance companies that have less points are statistically more likely to submit claims. This isn't personal, it's a statistical fact. The company believes that your spending habits indicate how likely you are likely to get involved in an accident, or submit a claim, even if you think it's unfair.

What is the cost gap? It's pretty large. In the example above, if a person who has excellent credit is quoted an annual sum of $1,200, those who have a poor credit score could get a quote as high as $2,000 to cover the same coverage. This is a huge cost of over $800 a year just for having a lower credit score.

Just a tiny drop in credit may result in a rate increase. A shift between "good" in comparison to "fair" may not appear as a major issue for insurers, however this could indicate that you're more risky. This is why certain drivers notice the cost of insurance increase after experiencing an economic hardship regardless of whether anything changes.

The good news is that a few states are pushing back. States such as California, Massachusetts, and Hawaii have halted or restricted the utilization of credit scores when setting the rates for car insurance. If you are a resident of one of them, rates are based upon your driving history and your location, rather than on your financial history.

However, across the U.S., credit counts. Understanding how insurance companies utilize credit can allow you to make more informed choices and ultimately, you'll pay less.

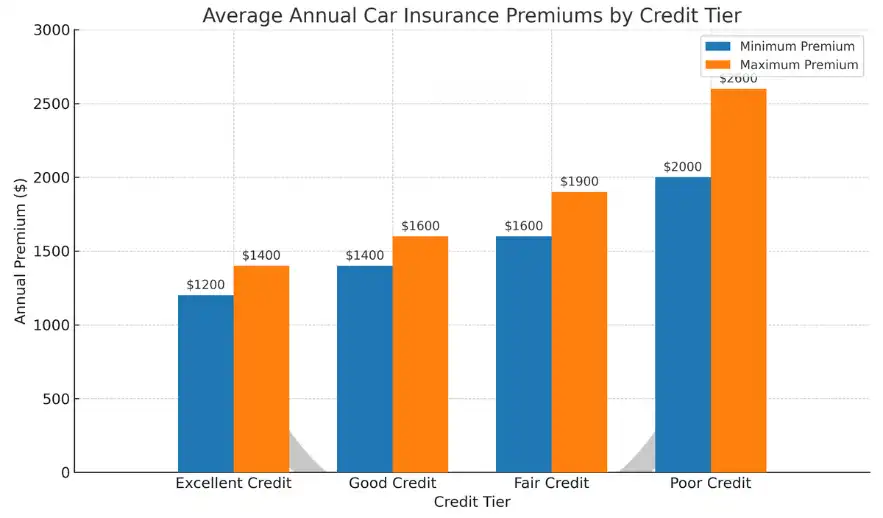

Average Car Insurance Rates Across Credit Tiers

Let's get specific. How much will your credit score affect your insurance rates for cars? These numbers may shock you.

Based on data from research reliable sources like Bankrate as well as Insurance Pittsburgh, here's a general overview of the average annual rates for each credit level:

| Credit Tier | Average Annual Premium |

|---|---|

| Excellent Credit | $1,200 - $1,400 |

| Good Credit | $1,400 - $1,600 |

| Fair Credit | $1,600 - $1,900 |

| Poor Credit | $2,000 - $2,600+ |

It's about a difference of $1,000 between good and bad credit. Multiply that number by five years and you'll see thousands of dollars simply because of your credit score.

However, it's not the same everywhere. In certain states, the contrast is greater. However, in other states, the difference is less. Let's look at states where insurance is impacted by credit the most:

- Michigan

- Texas

- Louisiana

- Florida

States where the impact is minimal or even nonexistent:

- California

- Hawaii

- Massachusetts

- Michigan (to a certain extent, as per the law changes)

Let's imagine two people — identical in age, the same driving history, the same vehicle — and they get insurance estimates in Texas. One of them has great credit and receives a quote of $1,300/year. The other has poor credit and is quoted $2,400 per year. This is almost twice as much, and that's purely based on credit scores.

What's the takeaway? It's not just about borrowing money. It's also a significant factor for your insurance costs. Knowing where you are within the credit tier can assist you in making more informed decisions on:

- Coverage

- Buying

- Spending

Explore more policies in our page on best car insurance in Pittsburgh.

How to Improve Your Credit Score

If your credit score has been dragging your insurance premiums for cars to the top of the list, it's good to know you're able to fix it. Credit doesn't last forever — it's fluid. If you make a few intelligent decisions, you'll be ascending the ladder and reduce the price of credit as you go.

Let's break it into easy results and longer-term strategies.

Quick Wins:

- Examine your credit report for mistakes: The report states that according to the FTC, one in five customers have errors in their credit records.

- Make sure you pay off excessive credit card balances: Credit utilization — which is the percentage of your credit card amount to your credit limit — can play a significant role. Make sure you stay under 30%.

- Make every payment on time: Payments that are late can be the biggest credit breaker. Create auto-pay or even reminders in case you must. A missed payment could be a problem for several months.

- Beware of applying for too many credits at once: Each time you apply for credit, a hard inquiry pops up. A lot of applications in a short time frame makes you appear risky.

Long-Term Habits:

- Maintain old accounts in good standing: The longer you've had your credit history, the better. Even if you don't use a credit card often, keeping the account active helps.

- Make sure you diversify your credit portfolio: The right combination of credit cards, automobile loans, and personal loans can boost your score.

- Utilize tools such as Experian Boost: It allows users to include utility and phone charges into your credit record — ideal for those building credit from scratch.

This is how it ties into your vehicle insurance. When your score rises, some insurance providers will automatically review your rates during renewal. Other companies may not change their rates until you call for a quote. Keep track of your score frequently. When you move up a tier (e.g. from "poor" to "fair"), contact your insurance provider or compare rates for a new quote.

Do you want to know how soon you'll see outcomes? The small improvements you see can be seen within the span of one month. Large shifts such as moving from bad to excellent -- could be a long time. However, even minor changes can help you save money. In the example above, increasing the score of your 580-point to 620 could cut $200-$300 off the cost of your insurance.

The process of improving your credit is akin to losing weight. It takes time But every small effort counts. The reward? Better rate of loans, and less pressure on your finances.

Car Insurance Discounts for Drivers

The silver lining is even with poor credit, you could still get huge car insurance savings. The majority of insurance companies offer a selection of offers that do not have anything in common with your credit score. It's a matter of understanding what to inquire about.

Let's look at the most popular discount offers, as well as those you've probably never ever heard of:

1. Safe Driver Discount

If you've had a perfect driving record -- without tickets, accidents or claims, you're good to go. A lot of insurance companies will ignore your credit history if you've demonstrated your self-respect on the road.

2. Bundling Discount

Are you covered by renters, homeowners and life insurance? Take it all together along with your auto insurance and you can save anything between 5 and 25 percent. More policies that you add to one business and the greater influence you will have.

3. Low Mileage Discount

If you travel lower than the average for your state (about 12,000 miles annually) you can request a lower mileage rate. Certain companies provide plans based on usage that monitor the amount of time you drive and pay you cheaper costs.

4. Defensive Driving Course Discount

Learn a course that has been certified whether in-person or online you can save as much as 10 percent. Insurance companies like this as this shows initiative and lowers the risk.

5. Pay-in-Full Discount

If you're able, making the payment up at the beginning (instead of a monthly payment) will result in savings. Also, it will avoid the installment fee.

6. Multi-Vehicle Discount

Are you able to insure more than one vehicle through the same company? There's a chance for another reduction.

7. Good Student Discount

Are you a parent or a college student in your coverage? If they keep an A or better most insurance companies offer between 10% and 15 percentage discount.

8. Affinity Group Discounts

Are you a part of a union, an alumni club, professional group, or union? It is possible that you qualify for group rates, even if you have bad credit.

Tips for Maximizing Discounts:

- Always inquire directly when looking about. Be skeptical of companies that provide them for you automatically.

- Make use of comparison tools such as The Zebra as well as Bank rate to compare savings side-by-side.

- Make sure to review your insurance policy each time it is renewed. Discounts may be altered depending on your current situation.

What's the bottom to bottom? No matter if credit issues are hindering your progress, stacking discounts could assist in leveling the playing field. By doing a little research and a little planning, you'll pay less than an individual with great credit that isn't able to navigate with the system.

Even with poor credit, it’s possible to secure the cheapest car insurance in Pittsburgh.

Ready to Get a Free Quick Quote?

Frequently Asked Questions for Car Insurance Credit Score

Let's close this article with a look at some of the most frequently asked concerns about the impact of credit on the cost of your auto insurance. If you've been wondering over how this all is working, you're not the only one. This FAQ will help you understand the confusion and allow you to make the right selections.

Do I have the right to be refused auto insurance due to a low credit score?

The truth is that most insurance companies won't simply deny your application due to poor credit. However, and this is not a blanket statement, the fact is that they may offer you rates so high that you're feeling like being denied. But the good news is that businesses such as Acceptance Insurance, Dairyland, The General, as well as Acceptance Insurance, The General are experts in dealing with high-risk drivers, which includes drivers with low credit scores.

Remember, several states, like California, Massachusetts, and Hawaii prohibit or restrict the use of credit scores for automobile insurance underwriting. Also, the place you live in makes an enormous difference.

Do I need to shop for insurance on cars will affect my score on credit?

It's a great question, as well as a fear that is common. What's the short answer? Nope. If you're looking to compare quotes, insurers will perform a "soft pull" of your credit report. It doesn't impact your credit score in any way.

The only hard inquiries (such as making an application for a new credit card or a loan) may temporarily affect your credit. It's a good idea to search around and obtain several quotations. Actually, it's the most effective way to get the cheapest cost.

How often are insurers checking your credit?

Usually, insurers look up your credit score if:

- The first step is to apply to be covered

- Renewal of an existing policy (sometimes)

Certain companies might not be able to re-evaluate your score until you ask for a fresh quote or alter the policy you are currently under. This means that if your score is improved significantly in mid-policy the company may not provide you with a higher price. It's a good idea to request a new evaluation and even think about switching insurance companies.

States that don't permit credit to be used in auto insurance?

In the present, states in these states have laws in place that restrict or even prohibit the use credit scores to calculate automobile insurance rates:

- California

- Hawaii

- Massachusetts

- Michigan (limits its usage in the reform law)

Many states are contemplating similar legislation and you should keep a close check on the local law. This could be a huge distinction in the amount you are charged.

Does improving my credit score reduce my mid-price on insurance?

The insurer will decide. Certain companies will only offer a price on renewal time, but other companies may let you ask for a new quote if your credit score has improved significantly.

Your best bet? Contact your insurance company and inquire for an update upon your current credit. If they don't then look into other options and determine how switching companies could save your money.

Conclusion

A bad credit score doesn't mean that it's impossible to get the highest automobile insurance forever. Your credit score can play a significant part in the price you pay which can amount to thousands in the span of the course of time. However, you're not completely powerless.

Understanding how insurance companies use your score, selecting the best companies by stacking discounts as well as working towards improving your credit score, you are able to reduce your monthly costs. Begin with small steps and persevere. Don't be afraid to ask for a lower rate or switching suppliers.

Don't forget that you're certainly not the only one. Many millions of Americans face the same issue. With just a little know-how and some smart moves you'll be able to bring your expenses to a minimum, regardless of the credit score you have now.