High-Risk Car Insurance

Table of Contents

The world of car insurance can be a challenge particularly when you are labeled a high risk driver. The high-risk insurance for cars, commonly called non-standard insurance, was created to protect those who are more likely to make claims based on a variety of factors. This kind of insurance generally has higher rates and more stringent terms that reflect the greater risk insurance companies associate with the drivers.

The understanding of high risk auto insurance is vital for individuals that fall in this type of situation. This type of insurance not only impacts the price of insurance but also affects the range of insurance options. Risky drivers might have limited options and more expensive deductibles, so it is essential to know the intricacies of this type of insurance for making informed choices.

Credit history also matters, making it important to check out Car Insurance for Drivers With Bad Credit.

What is High-Risk Car Insurance?

Definition and Overview

Car insurance with high risk is a special policy that's designed to those who are most likely to get into collisions or filing claims. The classification isn't random and is based on particular criteria insurers employ in assessing the risk. Things like a record of traffic-related violations as well as at-fault injuries, and any other demographic data may lead to a high risk category.

This kind of insurance differs from the standard insurance in many different ways. Prices are usually higher and the coverage options may be less extensive. Some insurers may also require more stringent terms, like needing an SR-22 certificate, which is a declaration of financial responsibility required by certain states for high risk drivers.

Common Reasons for High-Risk Classification

Many factors could lead to the driver being classified as a high-risk driver:

- Traffic Infractions: Numerous traffic tickets for speeding, DUIs or driving recklessly charges dramatically make risk profiles more threatening.

- Accident History: An accident history that shows you were the cause of any of the accidents indicates an increased likelihood of claiming future damages.

- Lack of Experience: Drivers who are new, particularly teenagers don't have the skills that lead to safe driving.

- Low Credit Score: A few insurance companies consider credit history in determining risk. They associate less credit scores with higher claims probability.

- Delays in Coverage: Insurance coverage gaps may indicate negligence, triggering warnings to insurers.

Recognizing these elements is the initial step to increasing one's risk and obtaining more advantageous coverage terms.

How Much is High-Risk Auto Insurance in Pennsylvania?

Average Costs and Factors Influencing Rates

In Pennsylvania, high-risk car insurance rates can be wildly different depending on your individual situation. The average is that high-risk motorists could pay significantly higher rates than low risk drivers. Some of the factors that influence these rates include:

- Driving Record: A record of accidents, or other violations leads to higher rates.

- Age and Experience: Younger drivers typically face higher costs because of their inexperience.

- The Type of Vehicle: High-performance or luxurious vehicles may increase costs for insurance.

- Area: Urban areas that are home to greater traffic volume could lead to higher rates.

- Credit History: Like previously mentioned that a low credit score could result in higher rates.

It is essential that drivers be aware of how these elements interact in affecting their insurance cost as well as to consider options to reduce these costs.

Comparison to Standard Insurance Rates

In comparing the premiums for high risk insurance with normal rates, the difference is often significant. A standard insurance policy could cost an average Pennsylvania motorist around $1,050 per year while a high-risk insurance policy can be anywhere from $1,500 up to at least $5,000 each year. The stark contrast underlines the necessity of keeping good driving records and a solid credit score in order to avoid being labeled high risk and the associated expenses.

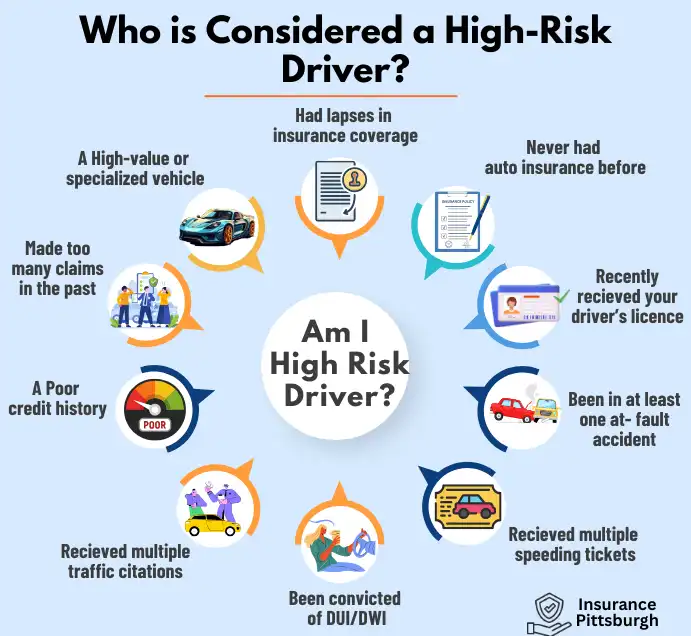

Who is Considered a High-Risk Driver?

Driving Record and Violations

The history of a driver in the roadway is a key factor when determining risk. Particular infractions that can contribute to an assessment of high risk comprise:

- DUI/DWI offence: Driving under the influence of alcohol is very serious and has a significant impact on alters the risk profile.

- Unsafe Driving: Behaviors that are excessively speedy or driving aggressively could be a red flag for insurance companies.

- Multiple accidents: A tendency to be the cause of accidents indicates an increase in the probability of future claim.

- Numerous Traffic Violations: Accumulating points on one's license as a result of different violations can result in the designation of a high risk.

Age, Experience, and Other Risk Factors

Beyond driving history, various aspects contribute to risk assessments:

- Young adults and teens: Tend to be more likely statistically to get involved in an accident which leads to more assessment of risk.

- Senior Drivers: The effects of age may affect reaction times as well as the ability to drive, impacting the risk assessment.

- People who are less frequent drivers: Could not be able to have the consistency that helps to develop safe behavior in driving.

- High-Risk Zones: Having areas with high rates of accidents or theft of vehicles can affect the risk profile.

Knowing these elements will allow drivers to be proactive to manage their risk profile.

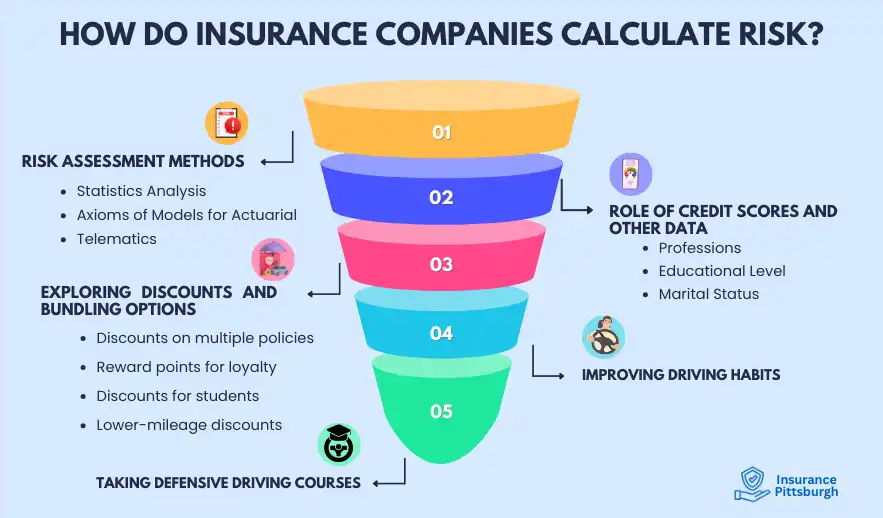

How Do Insurance Companies Calculate Risk?

Risk Assessment Methods

Insurance companies employ a range of techniques to evaluate the level of risk a driver is:

- Statistics Analysis: Insurance companies analyze information on incidents or violations as well as claims to find patterns and forecast the future risk.

- Axioms of Models for Actuarial: These types of models use algorithms and techniques that use statistics and math to assess the probability of an assertion based upon a range of aspects.

- Telematics: A few insurers utilize gadgets or applications to track the driving habits of drivers, such as brake patterns, speed and miles, in order for assessing risk in real-time.

Role of Credit Scores and Other Data

The credit history of a person plays an important part in the risk assessment process for many insurance companies. Research has shown that there is a connection between credit scores as well as the possibility of filing claims. So the lower score may result in greater rates. In addition, insurance companies may take into consideration:

- Professions: Some occupations can be linked to risks that are higher or less.

- Educational Level: A few studies show a connection between driving education and the behavior of drivers.

- Marital Status: Couples who are married are often perceived to be more secure and safer.

The way these elements affect insurance prices can assist drivers make better decisions and to make steps to enhance their risk profile.

Get more details on different coverages with our guide to car insurance in Pittsburgh, PA.

Improving Driving Habits

Making improvements to your driving behavior is among the most efficient strategies to cut down on your premiums for insurance, specifically when you've been identified as the high risk driver. Insurance companies take into account your past driving record when they determine the risk you face. This means that every time you sit behind the wheel, there's an opportunity to prove that you're a safe, prudent driver.

Be sure to obey traffic laws strictly--no speeding, not rolling over stop signals Also, avoid texting when driving. Beware of aggressive behavior like the habit of tailgating and frequent changes in lane without indicating. Smaller tickets could increase and affect the insurance you carry. With time having a good driving record will show the insurers that you're trying to get better.

Also, you should consider the possibility of driving less in general. If your insurance company provides a program for insurance based on usage that tracks how frequently you drive, and at the circumstances. The less time you spend on the roads usually means less risk that could result in less expensive costs.

Taking Defensive Driving Courses

A defensive driving program is not just an opportunity to improve the basics of driving. It can aid in reducing your insurance costs. Numerous insurance companies provide discounts for drivers who have completed state-approved training in particular if they're considered high risk.

They typically address topics such as accident prevention and safe following distances and ways to deal with road anger. You not only receive an official certificate to be presented to your insurance company however, you also acquire useful knowledge to aid in preventing the possibility of future incidents or violations.

For Pennsylvanians There are numerous in-person and online defensive driving programs approved by the state government and large insurance providers. Costs are usually affordable and the savings over time on insurance will exceed the initial expense.

Exploring Discounts and Bundling Options

Do not stop there at improving your driving skills, take the full benefit of each discount your insurance provider gives you. There are many ways to save money:

- Discounts on multiple policies: Combine your insurance for cars together with renters or homeowners insurance to save money.

- Reward points for loyalty: Being with the same insurance company over time may lead to reductions in costs.

- Discounts for students who are good: In the event that you're younger than 25 and are completing your studies and maintaining your GPA, a good grade will give you a break on the rates.

- Lower-mileage discounts: Are you driving lower than the average every year? A lot of insurance companies reward the driver for this.

Speak to your insurance representative and request them to look over your insurance policy. You may be shocked by how many discounts you are eligible to receive but don't use.

How Can I Save Money on My Auto Policy?

Shopping Around for Better Rates

If you're not constantly looking at quotes from various insurance companies, you're wasting money. Drivers who are at risk, particularly, are advised to shop around every year at least. Insurance companies weigh the risk of a particular factor differently. the factors that one insurer considers warning signs may not mean much in the other.

Make use of online tools for comparisons to compare quotes from a variety of firms swiftly. Search for firms which specialize in high-risk insurance or have second-chance insurance policies. Just a tiny difference in the monthly cost of premiums could result in huge savings over the course of the year.

High-risk drivers often need to shop carefully for cheap car insurance in Pittsburgh.

Make sure you read consumer reviews and third-party ratings too. A cheap insurance policy isn't worth the cost when the business has a difficult time dealing in the event that you have to submit an insurance claim.

Adjusting Coverage and Deductibles

Another method to reduce your cost is to adjust the settings of your insurance policy. Begin by looking at the amount of coverage you require. Although it's crucial to comply with the state's legal minimum requirements, you don't necessarily need more coverage than the minimum requirements, particularly when you're driving an older car.

The amount that you pay from your pocket prior to insurance taking effect - can decrease your monthly premium. Be sure to choose an amount that you are able to afford should you be involved in an accident.

Additionally, you can opt to eliminate the optional insurance coverages, such as roadside assistance and rental reimbursement when you aren't using the services. Every bit of money is important when you are trying to cut the cost of your monthly bills.

Utilizing Usage-Based Insurance Programs

UBI, also known as usage-based insurance (UBI) Also known as insurance that pays-as-you-drive can be a great choice for those who are at risk and strive to change their habits. These insurance programs keep track of the driving habits of your driver by using a telematics gadget or mobile application, and the safer you drive your car, the less you pay.

The most important behaviors typically tracked include:

- Acceleration and braking patterns

- Speed consistency

- Time of day you drive (late-night driving often incurs higher risk)

- Total mileage driven

If you're a responsible driver, and you mostly drive in daylight hours, UBI could save you hundreds of dollars per year. The Progressive's Snapshot and Allstate's Drive wise are both well-known UBI alternatives worth looking into.

Frequently Asked Questions

How much will car insurance rise after an accident?

Following an accident, particularly in the event that you're responsible Your insurance rates can be increased by 20% - 50%, based on the extent of the accident as well as the policies of your insurance company. In Pennsylvania this could be anywhere from $400-$800 each year. It is typically in your file for 3 to 5 years. For a less negative impact take into consideration the possibility of a grant for accidents that are available from your service supplier.

What is the length of time you are considered a high-risk driver?

In general, insurance companies will categorize the risk of your claim as high during 3 to 5 years following an incident that is major, such as the occurrence of a DUI or a serious traffic infraction. The timeframe can differ according to the severity of the offence and if you are convicted of a new offense. Maintaining a clean criminal record during the timeframe is crucial in order to be able to obtain standard insurance.

What is the top insurer for high-risk drivers?

Certain firms are more flexible or specialize in dealing with drivers who are at risk. GEICO, Progressive, The General and Dairyland generally offer affordable prices and policies that are tailored to. The best choice is dependent on your particular situation. Make sure you look at quotes and policies before settling on

Does my insurance increase regardless of whether the accident wasn’t my fault?

Unfortunately, yes--it can. Although Pennsylvania is a state that has no fault however, insurance companies may increase rates if they believe the level of risk has increased, particularly when more than one claim is involved. The increase, however, tends to be less pronounced that if you are found to be at fault.

What is the cost of high-risk insurance in Pennsylvania?

The high-risk insurance for cars in Pennsylvania usually ranges from $1500 to more than $5,000 annually depending on the driving history of your driver along with your age and insurance provider. A search for insurance companies and improving your driving skills could help you locate cheaper alternatives.

Are teens considered high-risk drivers?

Teens are nearly always categorized as high-risk because of their lack of experience and the statistically high rate of accidents. These results in higher rates typically double or even more than the premiums paid by experienced drivers. Discounts for students and instruction in driving may help reduce these expenses.

What makes my insurance cost more after a speeding ticket?

Tickets for speeding are an indication of reckless behavior which insurers view as an increased chance to make an insurance claim. The smallest ticket could increase your premium a little however, multiple violations can dramatically increase the cost of your insurance or cause your insurance to be cancelled.

Do I require an SR-22 in Pennsylvania after a DUI?

In contrast to other States, Pennsylvania is not a state that requires an SR-22 after a DUI. The DUI is still recorded on your driving record, and dramatically impacts your insurance premiums. There is a possibility that you'll need an insurance company that isn't standard in order to obtain coverage following a DUI.

Conclusion

Insurance for high-risk vehicles can seem like a huge burden however, it's not a death sentence. By using the proper strategies--such as making your driving better, investigating discounts and making smart purchases, you are able to gradually decrease your costs and then return to standard coverage. Know your risks, make proactive moves, and remain informed so that you can choose the most appropriate options regarding your car insurance needs.