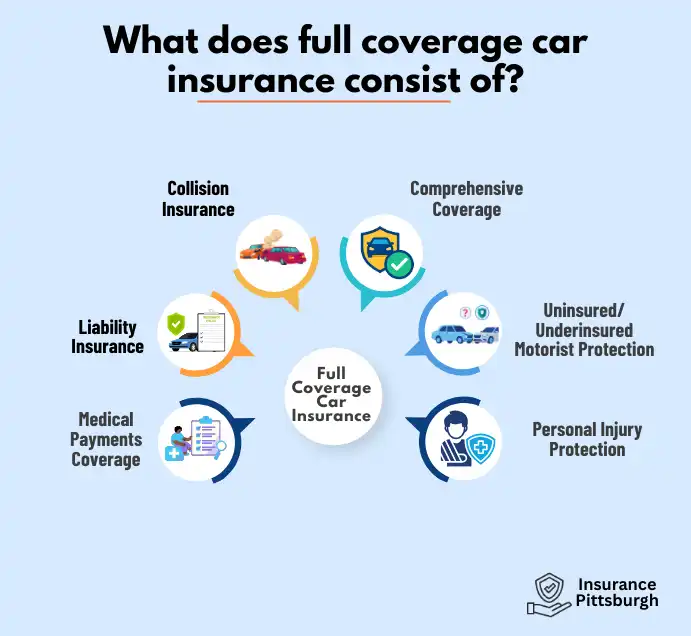

What exactly does the full coverage insurance for cars consist of?

Let's take it apart into a burger builder-style, because all coverage is customizable.

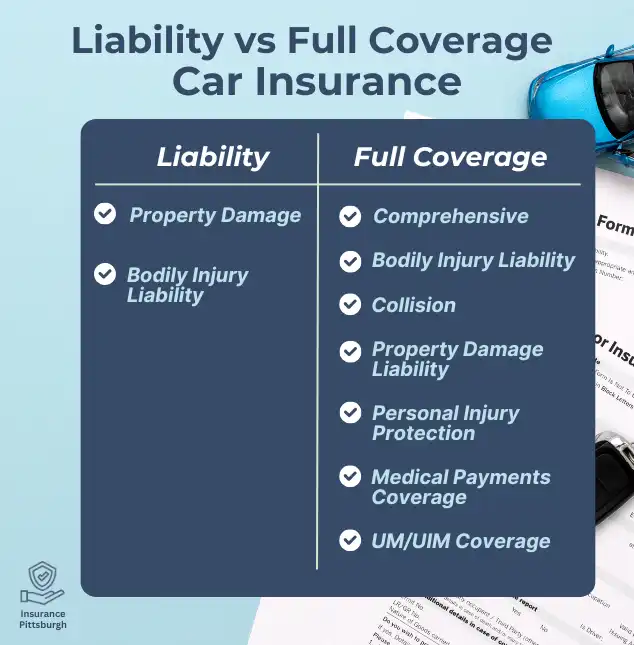

- Liability Insurance - covers injuries as well as damages that you cause others and their property. It is a requirement in PA.

- Collision Protection - covers damages to your car caused by an accident, no matter if it's in a collision with another vehicle, tree or even the pothole.

- Comprehensive Coverage - Handles non-collision damage. Consider vandalism, theft, floods, hail, fire and falling objects, even deer.

- Uninsured/Underinsured Motorist Protection - Covers your costs if the other driver doesn't have enough (or any) insurance.

- Medical Payments Insurance (MedPay) is a program that helps pay medical expenses for yourself and passengers regardless of the cause.

- Individual Injury Protection (PIP) is often included in PA policies. They cover loss of wages, medical expenses and much more.

The amount you pay is contingent on the worth of your car and how you utilize it, the habits you have with driving and budget. If you're looking to protect your car for a variety of situations, this trio of protection kinds is crucial.