Liability Car Insurance FAQs

Let's look at some of the most frequently asked questions that people ask about liability-only auto insurance. Since, let's face it: insurance terminology can be a foreign word. The FAQs below break down the language into plain English in order to make better choices.

What is Liability Auto Insurance, and Why Do I Need It?

The liability auto insurance policy can be your financial security net should you be at fault for an auto accident. It won't safeguard your car or injuries, it protects the person who caused the accident. This includes medical expenses as well as damage to their vehicle or other property.

It is necessary for three reasons.

- It's law in almost all states.

- The insurance protects you against legal action and massive out-of-pocket costs.

- The program helps patients recovering from injuries with no financial burden.

If you hurt someone but don't have insurance you may be sued, forfeit your savings or be liable for wage garnishment. Insurance coverage for liability stops the possibility of this occurring.

How Much Liability Insurance Should You Buy?

There's no universal answer to this. The minimum legal requirement may suffice to allow you to stay driving, but it isn't enough to ensure your safety. Many experts recommend:

100/300/100 ($100,000 per person to cover injuries to the body, $300,000 in for the total amount per accident and $100,000 for damage to property)

This is how you can decide:

- Are you a homeowner or have savings? Go higher.

- Do you drive a lot, or reside in an area that is crowded? Go higher.

- Are you a driver who lives from paycheck to paycheck? It's possible that you can live but it's not recommended.

What is the Difference Between Personal and Business Liability Car Insurance?

It's a great question and an essential one if you drive for business.

- Personal Liability Insurance: Insures the everyday needs of commuting, running errands, and road trips.

- Business Liability Insurance: Insures if you use your automobile for work-related purposes, like delivery of items, transportation of tools or attending to customers.

The catch is that if you are involved in an accident driving your own vehicle to conduct business, the insurance provider could refuse to pay the claim. If you're an Uber driver, contractor, or someone who delivers pizza, make sure you check with your insurance company for proof that you're insured.

Does Liability Car Insurance Cover Rental Cars?

Usually, no. The liability insurance you have may cover a rental vehicle however, it varies according to the state and the insurer. Certain insurance policies will cover the liability of driving a rental car, but they don't provide coverage for damage to the rental vehicle or the rental car itself.

Here's a simple guideline:

- Insurance on liability protects other persons and their property, regardless of whether you are driving or on a rental.

- Rental damage? It's your responsibility unless you purchase the collision damage waiver (CDW) by the rental business or own the credit card you use with rental insurance.

Be sure to check your insurance policy regularly and think about additional insurance if renting a car to go on an excursion or trip.

Can You Have Liability Insurance on a Financed Car?

Technically, it is possible but the lender will not allow this. If you have financed or leased your car, the finance or bank must have full insurance. This includes collision, liability and comprehensive.

Why? Because the vehicle isn't technically yours until the time it's fully paid for. The lender is trying to safeguard their investment from loss or damage.

If you are able to drop down to only liability on a vehicle you have financed or truck, the lender is likely to:

- Force-place insurance (which costs a great deal more), or

- Repossess the vehicle for breaching the loan contract.

It is only possible to switch to liability once the vehicle is cleared of debt and only when it is financially feasible.

Is Liability Insurance Only Enough to Protect Me?

It depends on the circumstance. The liability-only coverage is sufficient to ensure you're legal as well as protect drivers. If you're seeking insurance protection for yourself, your car or passengers, this isn't enough.

Ask yourself:

- Do I have the money to replace or repair my car completely out of my own pocket?

- How can I cover my own medical expenses following an accident?

- Am I at risk of getting accused of a violation that is greater than my insurance limits?

If the response to any of them is "no," then liability-only may not be sufficient. It's a great option for certain people, but an enormous risk for others.

Is liability insurance mandatory in every state?

Almost. Only New Hampshire and Virginia allow drivers to opt out—but they come with strict rules and financial responsibility requirements.

Can I switch from full coverage to liability only?

Yes, but only if your car is paid off. Talk to your insurer and run the numbers to see if it makes sense financially.

Will liability-only insurance affect my credit score?

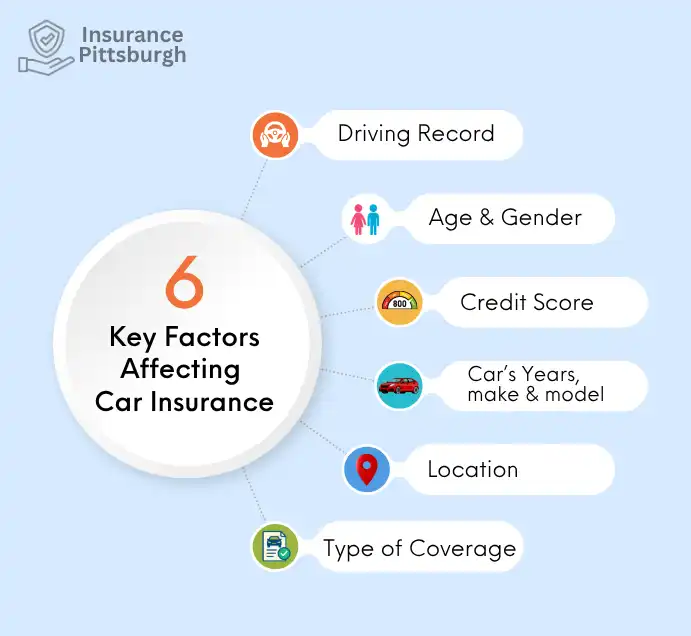

No, but your credit score can affect your insurance rate. Many insurers use credit-based scores to determine premiums.

What happens if I'm at fault in an accident with liability-only coverage?

Your insurance pays for the other person’s injuries and property damage—up to your policy limits. Anything beyond that? You’re on the hook.

How often should I review my liability insurance policy?

At least once a year or after any major life changes—like buying a new car, moving, or getting married. Always make sure your coverage fits your current needs.